Retention Stats D2C Teams Need On Their Fridge for 2025

I've been watching D2C teams obsess over acquisition metrics while their retention numbers collect dust in spreadsheets. Here's the thing: the brands winning market share right now have their retention stats memorized. Not buried in dashboards. Not in monthly reports. On their fridge. Where they see them every morning.

These aren't feel-good vanity metrics. These are the numbers that determine whether you're building a business or funding a leaky bucket. After analyzing retention patterns across hundreds of D2C brands, here are the stats that separate operators from spectators.

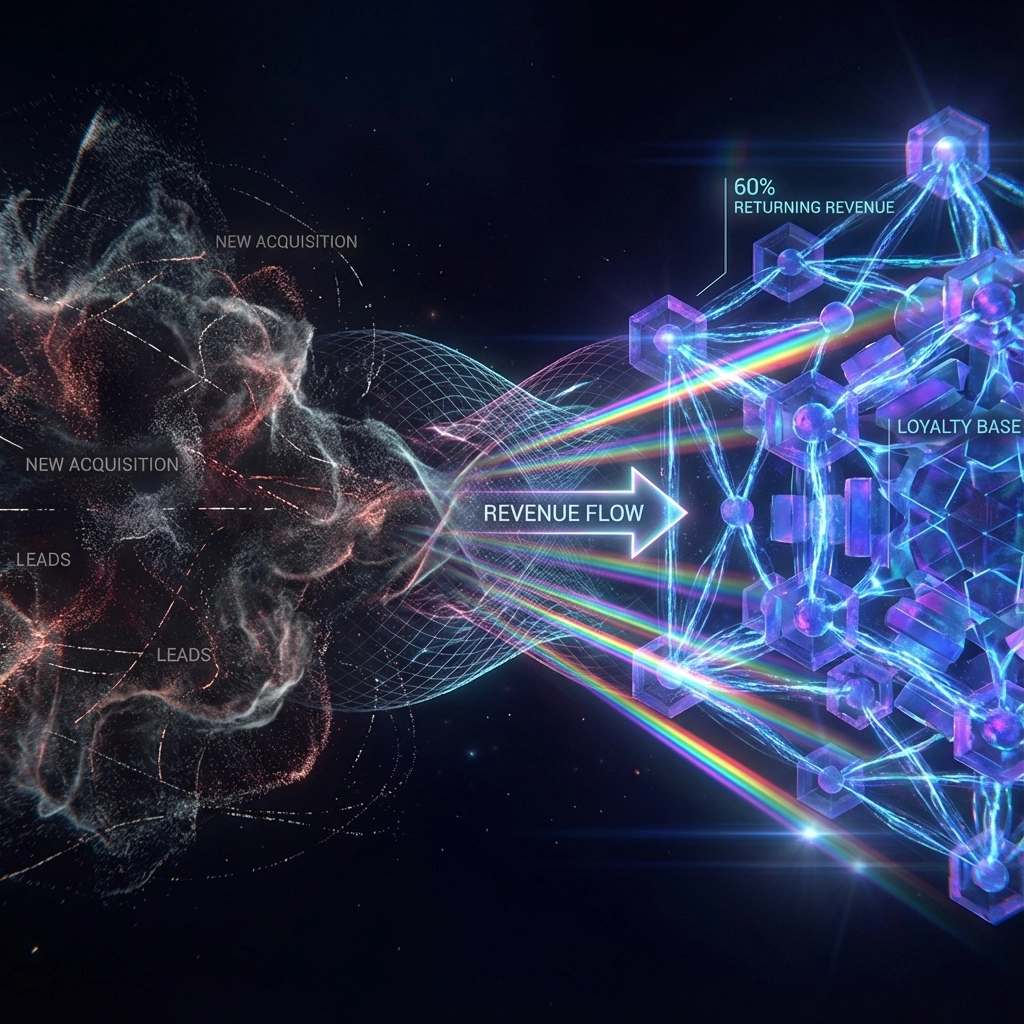

The Revenue Reality Check

60% of your revenue should come from returning customers. That's not a goal, that's table stakes for sustainable D2C brands in 2025. Yet I keep seeing teams celebrate first-time purchase spikes while their repeat revenue flatlines.

The math is brutal: DTC e-commerce sales from established brands hit $187 billion in 2025, up from $135 billion in 2023. The winners? Brands that shifted from acquisition-heavy campaigns to retention engines. The losers? Still burning cash on Facebook ads hoping this month will be different.

Here's what keeps me up at night: for 61% of small businesses, more than half their revenue comes from repeat customers. If you're not in that 61%, you're not building a business, you're running a very expensive customer sampling program.

Quick diagnostic: Pull up your revenue by customer type right now. If new customers represent more than 40% of your monthly revenue, you have a retention problem, not a growth problem.

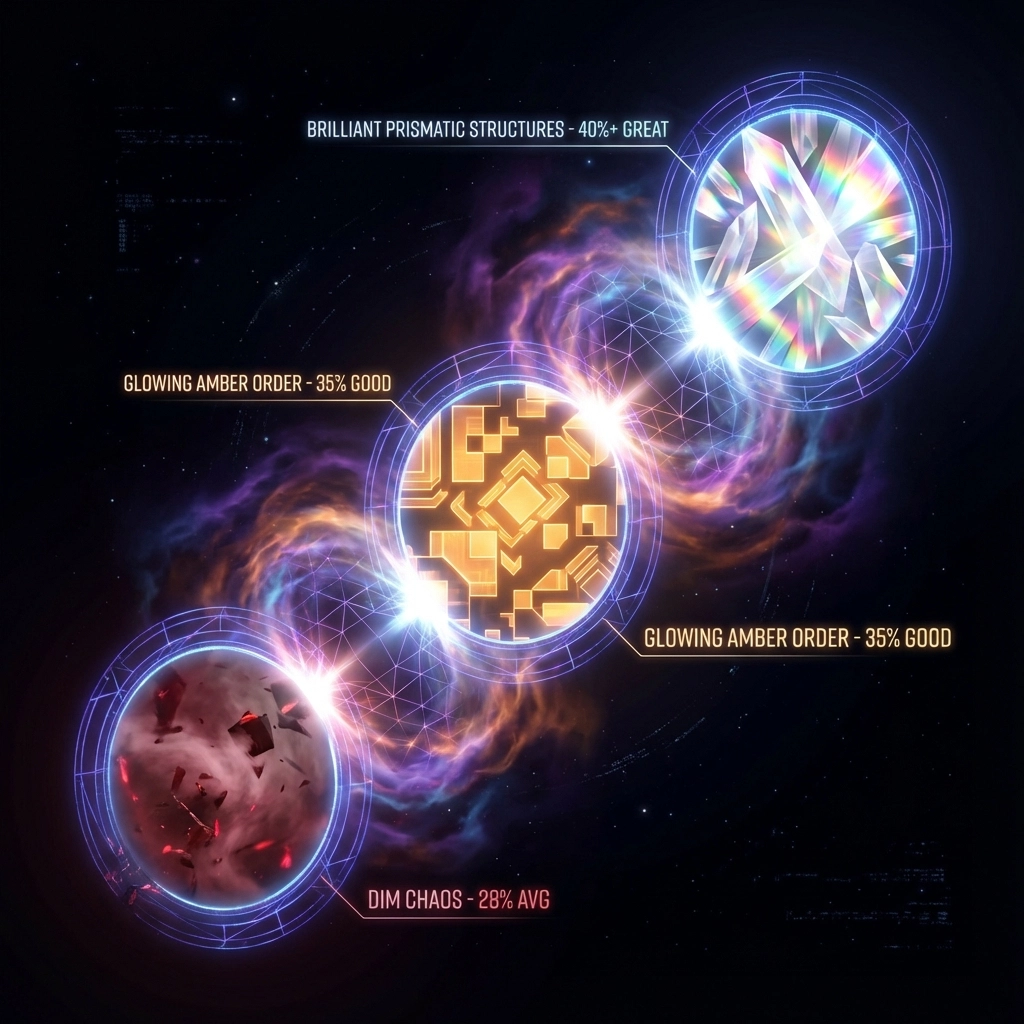

The Benchmark Wars

Average DTC retention rate: 28%. Good retention rate: 35%. Great retention rate: 40%+. These aren't participation trophies, they're the difference between profitability and private equity vultures circling.

But here's what most people miss: retention rates vary wildly by vertical. Shopping and e-commerce see 24.5% retention at 30 days, dropping to 10.7% at 90 days, and just 5.6% at one year. That's not a leak, that's a hemorrhage.

The churn ceiling: Keep monthly churn below 5%. Typical D2C churn ranges between 3-7%, but anything above 5% means you're in the danger zone. For subscription D2C models, monthly churn between 5-10% is standard, but aim for the lower end or you'll be fundraising every six months.

In practice, this looks like: if you're acquiring 1,000 new customers monthly but churning 7%, you need 70 new customers just to replace the ones walking out the back door. That's not growth, that's running in place on an expensive treadmill.

The Economics of Keeping vs. Getting

Customer retention is 5x less expensive than acquisition. Not 10% less. Not 50% less. Five times. Yet most D2C teams spend 80% of their energy on acquisition and wonder why their unit economics look like a horror movie.

The conversion advantage: Probability of selling to existing customers is 40% higher than to new prospects. This isn't about being nice to customers, this is about conversion rates that actually make sense.

I learned this the hard way: we burned $40K on a "revolutionary" acquisition campaign that delivered a 2.3% conversion rate. Our existing customer email campaigns? 12% conversion. Same product, same offer, different physics.

The loyalty multiplier: At Costco, executive-tier members represent less than half the membership base but drive over 73% of global sales. At Starbucks, 34 million Rewards members account for 60% of total revenue. These aren't accidents, they're proof that retention compounds while acquisition scales linearly.

The Channel Effectiveness Hierarchy

Email: 89% effective for retention. This isn't 2018. This isn't about batch-and-blast newsletters. This is about behavioral triggers, purchase-based segmentation, and automation that feels human.

Social media engagement: 63% effective. But here's what most teams get wrong: social media retention isn't about posting more content. It's about creating feedback loops between your product usage and social engagement. Behavioral AI vs traditional segmentation shows exactly how smart operators are making this work.

Direct mail: 55% effective. Yes, physical mail. In 2025. The brands using this aren't being nostalgic, they're exploiting a channel with zero digital noise.

The pattern here isn't channel preference. It's intimacy. Email wins because it's personal, immediate, and actionable. Social media works when it's community, not broadcast. Direct mail works because it's tangible surprise in a digital world.

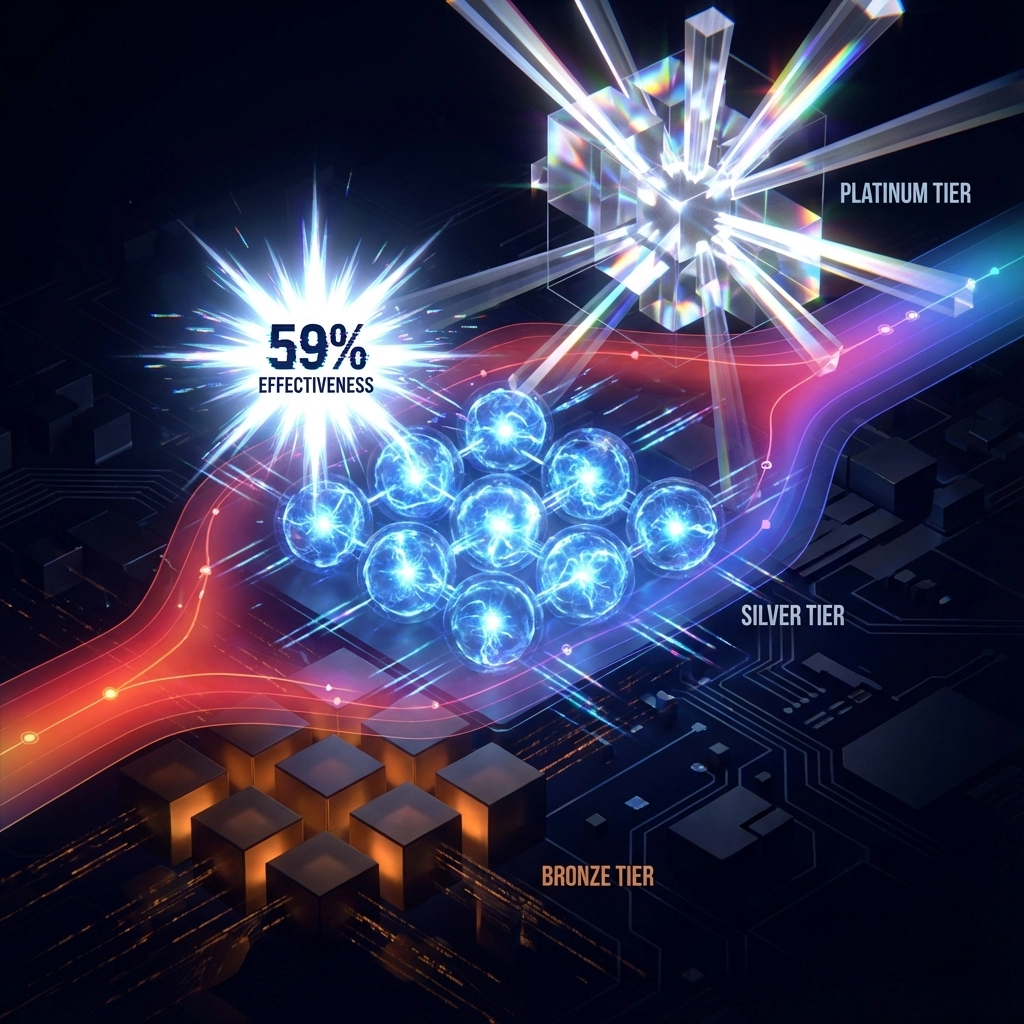

The Loyalty Program Reality

59% of sales leaders call loyalty programs the most effective tool for long-term retention. But here's where most programs die: they optimize for engagement instead of profitability.

I've seen loyalty programs that boost repeat purchases by 40% while destroying margins by 20%. That's not retention, that's subsidized shopping. The complete guide to crisis-proof retention breaks down how to build programs that protect margins while increasing loyalty.

The personalization multiplier: 48% of sales leaders say personalized outreach boosts customer retention. Not generic "Hi [First Name]" emails. Real personalization based on purchase history, browsing behavior, and lifecycle stage.

Here's the mechanism most people miss: personalization works because it reduces cognitive load. Instead of making customers figure out what they need, you're showing them exactly what makes sense for their situation. It's not marketing: it's service.

The Automation Advantage

AI-powered retention is moving from edge case to table stakes. The brands I'm watching closely have moved beyond basic email automation to predictive churn prevention, dynamic segmentation, and margin-aware offer optimization.

Real-time opportunity detection shows how smart operators are identifying at-risk customers before they churn, not after. The difference? Proactive retention costs 60% less than reactive winback campaigns.

The segmentation evolution: We're moving from demographic segments to behavioral micro-segments. Not "women 25-34" but "purchased twice in 60 days, browses on mobile, responds to scarcity messaging." From cart abandoners to profit champions demonstrates how this granular approach drives both retention and profitability.

The Hidden Cost of Getting This Wrong

Here's what most retention analyses miss: the emotional cost. When your retention strategy fails, you don't just lose customers: you lose team faith in the numbers. I've watched entire marketing teams become skeptical of their own data because their retention dashboard promised one thing and delivered another.

The diagnostic question: Be honest: when's the last time you looked at your retention curves by acquisition channel? If it's been more than a month, you're flying blind. Different channels attract different customer types with different lifetime values and different churn patterns.

The teams winning this game treat retention like compound interest. Small improvements in month two retention create massive differences in year two revenue. A 5% improvement in 30-day retention often translates to 25% higher lifetime value.

What This Means for 2025

The market is shifting toward retention-first growth models. Customer acquisition costs aren't coming down. iOS 14.5 isn't getting reversed. Third-party cookies aren't coming back. The brands that survive will be the ones that perfect the art of keeping customers, not just getting them.

If your retention metrics aren't on your fridge, they're not in your brain. And if they're not in your brain, they're not driving your decisions. The ultimate guide to AI-powered customer retention provides the frameworks for making retention your competitive advantage.

The question isn't whether you'll focus on retention. The question is whether you'll be early or late to a game that's already started.