Your Year-End Retention Audit: 10 Signs You're Bleeding Profits (And How Behavioral AI Fixes It)

The end of 2025 is here, and while you're celebrating another year of growth, there's a silent profit killer lurking in your retention strategy. Companies lose an average of 23% of their annual revenue to preventable churn, yet most businesses enter the new year completely blind to these profit leaks.

Your year-end retention audit isn't just a nice-to-have, it's your roadmap to plugging the holes that are draining your bottom line. The difference between companies that thrive in 2026 and those that struggle? They know exactly where their retention strategy is failing and they fix it with surgical precision.

Here are the 10 warning signs your retention strategy is bleeding profits, and how behavioral AI transforms each weakness into a competitive advantage.

Sign #1: You're Treating All Customers Like They're the Same

The Profit Leak: Your email campaigns blast the same discount codes to million-dollar enterprise clients and first-time browsers. Your "VIP" program rewards based on total spend without considering purchase frequency, lifetime value trajectory, or engagement patterns.

The Cost: When you treat a customer who spends $10,000 monthly the same as someone who bought once for $50, you're either over-discounting your best customers (killing margins) or under-serving your high-potential prospects (losing future revenue).

How Behavioral AI Fixes It: Instead of crude demographic or purchase-based segments, behavioral AI analyzes real-time interaction patterns, engagement velocity, and micro-behaviors to create dynamic customer personas. It identifies the subtle difference between a "loyal buyer taking a break" and a "customer at risk of churning" – often weeks before traditional methods would catch it.

The result? Personalized retention strategies that increase customer lifetime value by 35% while reducing discount dependency by 40%.

Sign #2: Your Churn Prediction Happens After Customers Leave

The Profit Leak: You calculate churn rates monthly or quarterly, essentially performing an autopsy on already-lost customers. By the time your reports show increased churn, you've already lost thousands in revenue and the opportunity to retain those customers.

The Cost: Acquiring a new customer costs 5-25x more than retaining an existing one, yet most companies only realize they have a retention problem after their best customers are already gone.

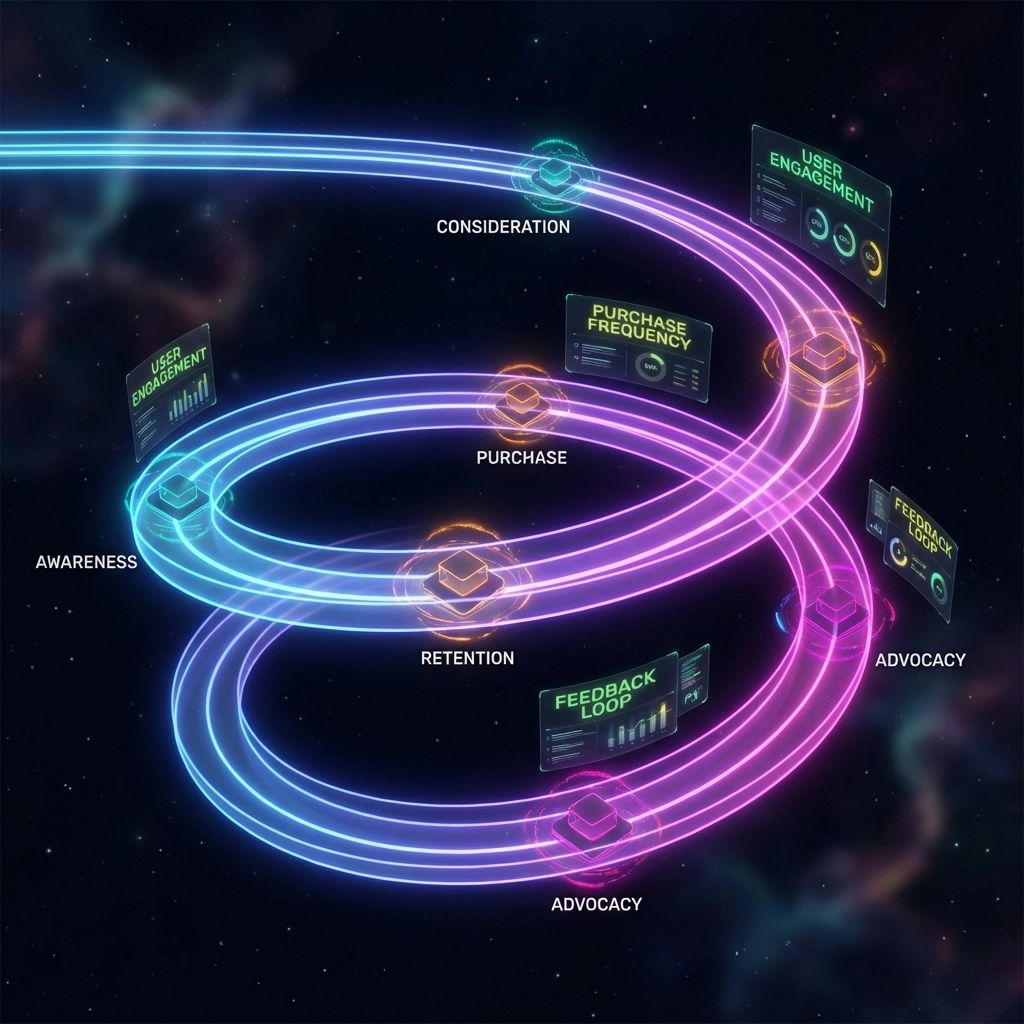

How Behavioral AI Fixes It: Real-time opportunity detection monitors customer behavior continuously, flagging micro-signals that indicate declining engagement: decreased login frequency, longer gaps between purchases, reduced feature usage, or subtle changes in interaction patterns. Instead of waiting for customers to churn, you intervene during the "consideration" phase when retention is still possible.

Companies using real-time opportunity detection see churn reduction of up to 40% because they act on intent, not just outcomes.

Sign #3: Your Retention Campaigns Are Response-Based, Not Outcome-Based

The Profit Leak: You measure success by open rates, click-through rates, and engagement metrics instead of actual revenue retention and profit margins. A campaign with high engagement but low conversion is celebrated while a low-engagement campaign that retains high-value customers is overlooked.

The Cost: You're optimizing for vanity metrics while your most profitable customers slip away quietly. High engagement doesn't equal high retention, and high retention doesn't always equal high profitability.

How Behavioral AI Fixes It: Behavioral AI tracks the complete customer journey from initial engagement through actual retention outcomes and revenue impact. It identifies which specific interventions (not just which campaigns) lead to profitable customer retention and automatically optimizes future strategies based on margin impact, not just response rates.

Sign #4: You Can't Tell the Difference Between Price-Sensitive and Value-Seeking Customers

The Profit Leak: Your retention strategy defaults to discounting because you can't distinguish between customers who will stay with the right value proposition versus those who will only stay for the lowest price.

The Cost: Over-discounting reduces profit margins by an average of 15-30% while under-serving value-seeking customers who would pay full price for better experience, support, or product features.

How Behavioral AI Fixes It: By analyzing purchase patterns, browsing behavior, and response to previous offers, behavioral AI identifies customer motivation profiles. Price-sensitive customers get strategic discounts timed for maximum impact, while value-seeking customers receive enhanced service, exclusive access, or product upgrades that increase both retention and margins.

Sign #5: Your High-Value Customers Are Getting Low-Touch Treatment

The Profit Leak: Your automated systems treat customers who generate 80% of your revenue the same as occasional buyers. Your highest-value customers receive generic retention efforts while your marketing budget focuses on acquiring new, unproven prospects.

The Cost: When you lose a high-value customer, you don't just lose their current spend, you lose their entire future lifetime value, often tens of thousands of dollars per customer.

How Behavioral AI Fixes It: Behavioral AI automatically identifies your most valuable customer segments and creates specialized retention workflows. High-value customers receive proactive outreach, dedicated support channels, and customized experiences that match their specific behavior patterns and preferences.

The result? 92% retention rates for top-tier customers compared to industry averages of 65-70%.

Sign #6: You're Fighting Churn Instead of Building Loyalty

The Profit Leak: Your retention efforts are reactive, win-back campaigns, last-minute discounts, and "please don't leave" messages. You're constantly in firefighting mode instead of building genuine customer loyalty.

The Cost: Reactive retention is expensive and often ineffective. Customers who are "won back" with discounts have 50% higher churn rates than customers who never considered leaving in the first place.

How Behavioral AI Fixes It: Instead of waiting for churn signals, behavioral AI identifies opportunities to deepen customer relationships during positive interactions. It recognizes when customers are most receptive to upsells, when they're discovering new value, and when they're most likely to become advocates.

This proactive approach builds genuine loyalty that reduces churn naturally while increasing customer lifetime value.

Sign #7: Your Retention Strategy Ignores Customer Lifecycle Stages

The Profit Leak: New customers receive the same retention treatment as loyal customers nearing the end of their lifecycle. You're not matching your retention intensity to where customers are in their journey with your brand.

The Cost: New customer churn in the first 90 days can reach 50%, while mature customers might churn for completely different reasons that require different solutions.

How Behavioral AI Fixes It: Behavioral AI maps each customer's position in their unique lifecycle and applies appropriate retention strategies. New customers get onboarding optimization and early-win campaigns, while mature customers receive loyalty deepening and expansion opportunities.

Sign #8: You Can't Measure the ROI of Your Retention Investments

The Profit Leak: You spend money on retention campaigns, loyalty programs, and customer success initiatives without clear measurement of which investments actually drive profitable retention.

The Cost: Marketing budgets are wasted on retention strategies that feel good but don't move the revenue needle. Meanwhile, high-impact retention opportunities go unfunded because their value isn't visible.

How Behavioral AI Fixes It: Every retention action is tracked to revenue outcomes and profit margins. You can see exactly which strategies generate positive ROI and double down on what works while eliminating what doesn't.

Companies using AI-powered retention optimization see 3.2x ROI on retention investments compared to traditional approaches.

Sign #9: Your Team Is Making Retention Decisions Based on Gut Feeling

The Profit Leak: Customer success managers, sales teams, and marketing teams make retention decisions based on intuition, incomplete data, or outdated customer information.

The Cost: Human intuition is right about customer behavior roughly 60% of the time: which means 40% of your retention decisions are suboptimal or actively harmful to profitability.

How Behavioral AI Fixes It: Every team member has access to real-time behavioral insights and AI-recommended actions. Instead of guessing what might retain a customer, they know exactly which approach has the highest probability of success based on that customer's behavioral profile.

Sign #10: You're Not Learning from Your Retention Failures

The Profit Leak: When customers churn, you might send an exit survey, but you're not systematically analyzing why your retention efforts failed and how to prevent similar losses in the future.

The Cost: You repeat the same retention mistakes because you're not extracting learnings from failures and feeding them back into your strategy.

How Behavioral AI Fixes It: Every churn event becomes a learning opportunity. Behavioral AI analyzes what signals were missed, which interventions were tried, and why they failed. These insights automatically improve future retention predictions and strategy recommendations.

Your 2026 Retention Advantage Starts Now

The companies that will dominate retention in 2026 aren't the ones with the biggest budgets: they're the ones with the clearest view of where they're losing money and the most precise tools to fix it.

Behavioral AI doesn't just identify these profit leaks: it fixes them automatically. While your competitors are still running quarterly retention reports, you'll be preventing churn in real-time. While they're treating all customers the same, you'll be delivering personalized retention strategies that increase both loyalty and margins.

The question isn't whether you can afford to implement behavioral AI for retention optimization. The question is whether you can afford another year of bleeding profits while your competitors gain the advantage.

Ready to see exactly where your retention strategy is leaking profits? Start your retention audit and discover how behavioral AI can transform your biggest retention challenges into your strongest competitive advantages.

Don't let 2026 be another year of wondering why your retention rates aren't improving. Make it the year you finally plugged the leaks.