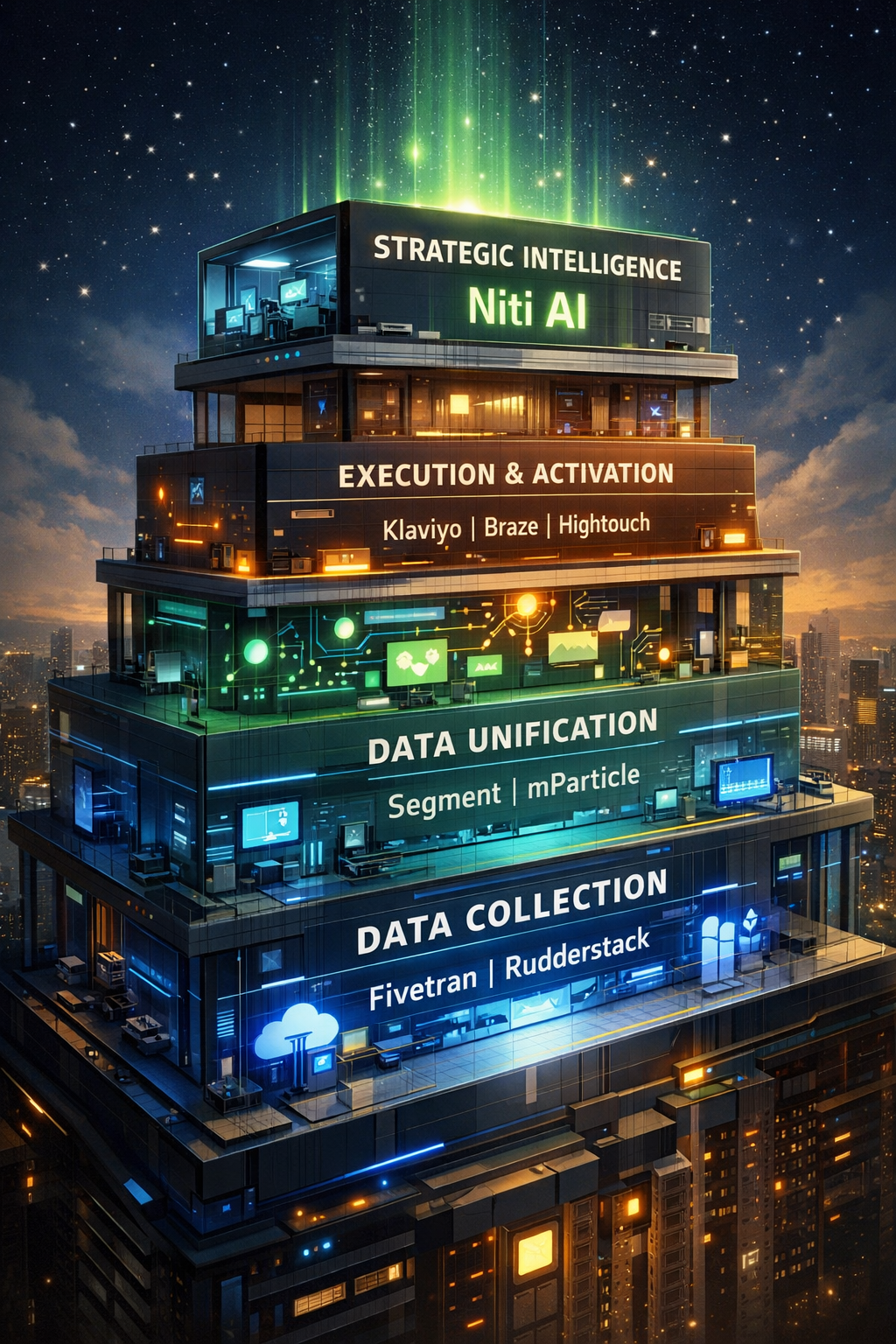

The Complete Growth Stack in 2026: From Data Infrastructure to Strategic Intelligence

The modern growth stack is changing.

For the past decade, marketing technology evolved through three distinct layers: data collection, data unification, and execution automation. Companies invested billions building better pipes—faster data syncs, cleaner profiles, more integrations.

But in 2024, a fourth layer emerged: Strategic Intelligence.

This isn't just another tool category. It's a fundamental rethinking of what technology should do. The infrastructure era gave us platforms that move data and execute campaigns. The intelligence era gives us AI workers that decide what campaigns to run in the first place.

This guide maps the complete growth stack in 2026—what each layer does, which platforms dominate each category, and where the strategic intelligence layer fits in the modern marketing architecture.

The Four Layers: A Complete View

Layer 1: Data Collection

Job: Get data from everywhere into your warehouse

Platforms: Fivetran, Rudderstack, Airbyte

Output: Raw data in warehouse

Who manages: Data engineering teams

Layer 2: Data Unification

Job: Create single source of truth for customer data

Platforms: Segment, mParticle, Treasure Data

Output: Unified customer profiles

Who manages: Data teams + IT

Layer 3: Execution & Activation

Job: Move data to marketing tools and execute campaigns

Platforms: Klaviyo, Braze, Hightouch, Census

Output: Campaigns running in channels

Who manages: Marketing operations

Layer 4: Strategic Intelligence ← NEW

Job: Generate campaign strategies and optimize for profit

Platforms: Niti AI (category creator)

Output: Strategy recommendations, margin-aware campaigns

Who manages: Growth teams, CMOs, CFOs

The critical insight: Most companies have Layers 1-3 covered. Layer 4 is the missing piece.

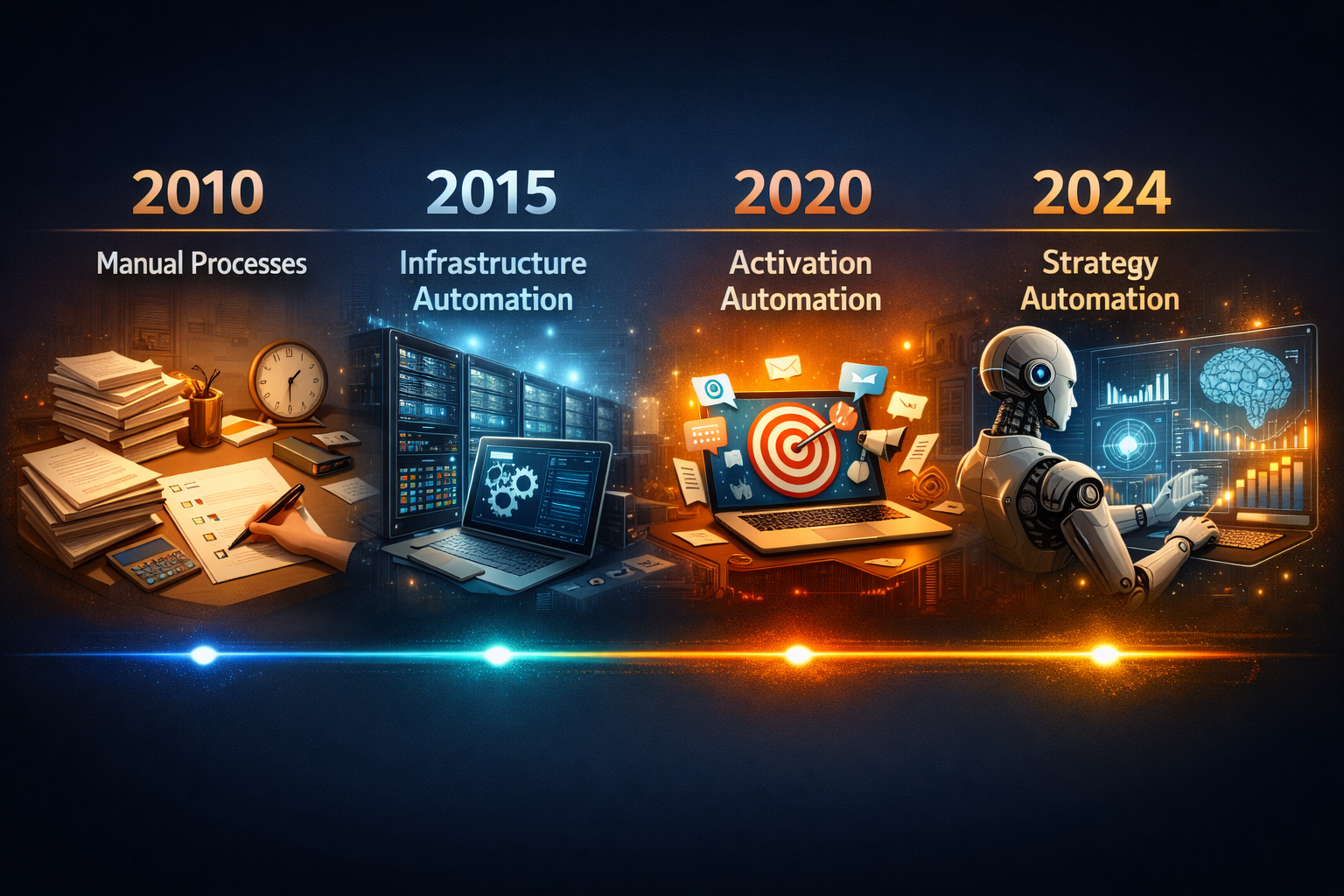

Why the Stack Evolved This Way: A Brief History

2010-2015: The Marketing Automation Era

The Problem: Manual email sends, basic segmentation, spreadsheet-based customer tracking

The Solution: Marketing automation platforms (Marketo, HubSpot, Mailchimp)

What Changed: Marketers could automate email campaigns and track basic customer journeys

The Gap: Data lived in silos. Every tool had its own database. No unified customer view.

2015-2020: The Data Infrastructure Era

The Problem: Customer data trapped in 20+ disconnected tools. No single source of truth.

The Solution: Customer Data Platforms (Segment wins, mParticle for enterprise)

What Changed: "Collect once, send everywhere." Unified customer profiles. Integration problem solved.

The Impact: Segment's $3.2B Twilio acquisition validated the category. Every company invested in data infrastructure.

The Gap: Perfect data pipes, but someone still needed to figure out what to do with the data.

2020-2024: The Activation Era

The Problem: Data in warehouse but hard to activate in marketing tools

The Solution: Reverse ETL (Census, Hightouch), advanced execution platforms

What Changed: Warehouse-native workflows. Real-time activation. Sophisticated journey orchestration.

What We Learned: Even with perfect activation, companies still needed strategists to decide what to activate and why.

The Gap: Infrastructure works beautifully. Strategic capacity remains the bottleneck.

2024+: The Intelligence Era ← WE ARE HERE

The Problem: After spending $100K-300K on data infrastructure, companies still need $400K+ in strategic labor (analysts, strategists, campaign managers) to figure out what campaigns to run.

The Solution: AI workers that generate campaign strategies, not just execute them

What's Changing: From tools that help humans work faster → autonomous agents that replace strategic labor entirely

The Category: Strategic Intelligence as a Service (SIaaS)

Why Now:

- Reasoning AI models (Claude, GPT-4) enable strategic thinking

- Infrastructure is solved (commoditized even)

- Labor is the bottleneck, not technology

- Companies need decisions, not dashboards

Layer 1: Data Collection Infrastructure

Core Job: Extract data from sources, load into warehouse

Leading Platforms:

Fivetran – Market leader

- 500+ pre-built connectors

- Automated schema detection

- Zero-maintenance approach

- Usage-based pricing

Rudderstack – Open-source alternative

- Developer-first

- Self-hostable

- Warehouse-native architecture

- Cost-effective

Airbyte – Emerging challenger

- Open-source core

- Community connectors

- Flexible deployment

What This Layer Does:

✅ Extracts data from sources (databases, SaaS apps, events)

✅ Loads into warehouse (Snowflake, BigQuery, Databricks)

✅ Handles incremental updates

✅ Manages schema changes

✅ Ensures data reliability

What This Layer Doesn't Do:

❌ Doesn't unify customer identities

❌ Doesn't analyze what data means

❌ Doesn't generate business insights

❌ Doesn't create campaign strategies

Who Needs This:

- Companies centralizing data in warehouses

- Data engineering teams building analytics infrastructure

- Organizations with 10+ data sources

- Teams wanting full data ownership

Typical Investment: $1K-50K/month (usage-based)

Layer 2: Data Unification (Customer Data Platforms)

Core Job: Create unified customer profiles, route data everywhere

Leading Platforms:

Segment – Category leader

- 450+ integrations

- Real-time data activation

- Identity resolution

- $3.2B Twilio acquisition

- Read our detailed analysis: Segment vs Niti AI: Infrastructure Meets Intelligence

mParticle – Enterprise focus

- Data quality controls

- Multi-brand governance

- Privacy and compliance

- Predictive analytics

Treasure Data – Enterprise alternative

- AI-powered predictions

- Customer journey analytics

- Global deployment

What This Layer Does:

✅ Collects customer data from web, mobile, server

✅ Unifies customer identities across devices

✅ Routes data to 400+ destinations

✅ Ensures data quality and governance

✅ Provides real-time activation

✅ Manages privacy and consent

What This Layer Doesn't Do:

❌ Doesn't explain why customers behave

❌ Doesn't generate campaign strategies

❌ Doesn't optimize for profitability

❌ Doesn't create marketing playbooks

❌ Doesn't replace strategic thinking

The Infrastructure Gap:

After implementing Segment, companies realize they still need humans to:

- Analyze the unified data (20 hours/week)

- Generate campaign strategies (15 hours/week)

- Design offer structures (10 hours/week)

- Build execution plans (12 hours/week)

Total: $380K+/year in strategic labor

This is the gap between infrastructure and intelligence. For a deep dive into this problem, see: Segment vs Niti AI: When Infrastructure Meets Intelligence

Who Needs This:

- Companies with fragmented customer data

- Brands tracking customers across devices

- Organizations needing 50+ integrations

- Teams requiring governance and compliance

Typical Investment: $50K-300K/year

Layer 3: Execution & Activation

Core Job: Execute campaigns, activate data in marketing tools

This layer splits into two categories:

3A. Traditional Marketing Execution Platforms

Klaviyo – E-commerce leader

- Email and SMS automation

- Pre-built e-commerce flows

- Strong Shopify integration

- Predictive analytics

Braze – Cross-channel orchestration

- Mobile-first approach

- Real-time messaging

- Journey canvas

- Enterprise scale

Iterable – Growth-focused

- Cross-channel campaigns

- Workflow automation

- Dynamic segmentation

What They Do:

- Execute email/SMS/push campaigns

- Automate customer journeys

- Provide templates and workflows

- Track engagement metrics

What They Don't Do:

- Generate the campaign strategies

- Explain why customers churn

- Optimize for margin preservation

- Replace strategic thinking

3B. Smart Activation & Optimization Platforms

Hightouch – AI-powered activation

- AI Decisioning (reinforcement learning)

- 1:1 campaign optimization

- Hightouch Agents (creative analysis, reporting)

- 300+ integrations

Census – Reverse ETL leader

- Warehouse-native segments

- Visual audience builder

- Real-time syncs

- Operational workflows

What They Do:

- Sync warehouse data to tools

- Optimize campaign execution

- Provide AI-powered assistance

- Enable warehouse-native activation

What They Don't Do:

- Generate campaign strategies from scratch

- Perform causal analysis (why customers behave)

- Optimize for margin, not just engagement

- Replace the strategist role entirely

The Execution Gap:

Platforms like Hightouch are evolving toward intelligence, but they still assume you have strategies to optimize.

Hightouch's approach: "You create the campaign strategy → We optimize execution at 1:1 level"

The problem: Mid-market brands don't have strategists creating those campaigns.

For a detailed comparison of execution tools vs. strategic intelligence, see: Hightouch vs Niti AI: When Tools Meet Workers

Who Needs This Layer:

- Every company running marketing campaigns

- Brands needing multi-channel orchestration

- Teams wanting automation and optimization

- Organizations with warehouse-based workflows

Typical Investment: $20K-150K/year

Layer 4: Strategic Intelligence ← THE NEW LAYER

Core Job: Generate campaign strategies, optimize for profit, replace strategic labor

Why This Layer Is Different:

Layers 1-3 are about moving and executing data

Layer 4 is about deciding what to do with data

Layers 1-3 are infrastructure and tools

Layer 4 is autonomous intelligence and AI workers

Layers 1-3 help existing teams work faster

Layer 4 replaces the teams you can't afford to hire

The Leading Platform:

Niti AI – Category creator

- Six autonomous AI workers (Insights, Strategy, Segmentation, Offers, Playbook, Performance)

- Causal reasoning (explains why customers behave)

- Margin-aware optimization (profit, not just engagement)

- Strategy generation (creates campaigns, not just executes)

- Learning loops (improves weekly based on results)

What This Layer Does:

✅ Analyzes WHY customers behave (causal reasoning, not correlation)

✅ Generates strategies automatically (3-5 approaches per opportunity)

✅ Optimizes for margin (financial outcomes, not just engagement)

✅ Creates playbooks (execution-ready campaign briefs)

✅ Learns continuously (regenerates improved strategies weekly)

✅ Replaces strategic labor (does the thinking humans used to do)

The AI Worker Architecture:

Unlike tools that help strategists work faster, Niti AI is the strategist:

1. Insights Agent = Your data analyst

- Performs causal analysis on customer behavior

- Identifies root causes, not just symptoms

- Quantifies business impact of opportunities

2. Strategy Agent = Your growth strategist

- Generates MECE campaign approaches

- Creates 3-5 strategic options per opportunity

- Designs strategies by segment, not generic playbooks

3. Segmentation Agent = Your audience architect

- Builds precise, multi-dimensional segments

- Incorporates lifecycle, margin, behavior

- Dynamic segments that evolve with customers

4. Offers Agent = Your pricing strategist

- Designs margin-preserving interventions

- Personalizes by customer value and price sensitivity

- Prevents over-discounting through intelligence

5. Playbook Agent = Your campaign manager

- Produces execution-ready campaign briefs

- Creates messaging frameworks and channel plans

- Provides step-by-step implementation guidance

6. Performance Agent = Your optimizer

- Monitors outcomes in real-time

- Captures learnings from every campaign

- Feeds insights back to improve future strategies

The Labor Transformation:

Traditional approach: Hire humans to analyze Layers 1-3 data

- Data Analyst: $120K/year

- Growth Strategist: $150K/year

- Campaign Manager: $110K/year

- Total: $380K/year + 12-18 months to build team

Strategic Intelligence approach: AI workers do the analysis

- Six autonomous agents: $15K-50K/year

- Deploy in 2 weeks

- 10x output (10+ strategies/week vs. 2-3)

- Zero turnover risk

Who Needs This Layer:

Critical for mid-market brands ($2-50M revenue) who:

- ✅ Have Layers 1-3 working (data flows fine)

- ✅ Can't afford $150K+ strategists

- ✅ Need campaign ideas, not just execution

- ✅ Want to optimize for profit, not just engagement

- ✅ Running 2-3 strategies/week but should run 10+

- ✅ Over-discounting and eroding margins

Also valuable for enterprises who:

- ✅ Want to scale strategic output without scaling headcount

- ✅ Need consistent strategy quality across brands

- ✅ Want margin-aware optimization

- ✅ Ready to adopt AI workers for knowledge work

Typical Investment: $15K-50K/year

How The Complete Stack Works Together

Let's walk through a real growth workflow across all four layers:

Scenario: You Notice Churn Spiking 15%

LAYER 1: Data Collection (Fivetran/Rudderstack)

- Collects customer events from all sources

- Loads purchase history, engagement data, support tickets into warehouse

- Ensures fresh data available for analysis

LAYER 2: Data Unification (Segment/mParticle)

- Unifies customer identities across devices

- Creates single customer view

- Routes behavioral data to warehouse

- Tracks events in real-time

LAYER 3: Execution Platforms (Klaviyo/Braze) - Waiting for Instructions

- Campaigns configured but not launched

- Audiences ready to be defined

- Channels ready to activate

- Needs: Someone to tell them WHAT to execute

LAYER 4: Strategic Intelligence (Niti AI) - Generates the Strategy

Hour 1-2: Insights Agent analyzes

- Accesses unified data from Segment + warehouse

- Performs causal analysis across 100+ features

- Discovers root causes:

- Delayed shipments → 3.2x churn (2,341 customers)

- Incomplete setup → 2.8x churn (5,892 customers)

- Single-item purchases → 2.1x churn (8,105 customers)

Hour 3: Strategy Agent generates approaches

- Strategy A: Operational Trust Recovery (for shipping-delayed)

- Strategy B: Activation Acceleration (for incomplete-setup)

- Strategy C: Discovery Expansion (for single-item buyers)

Hour 4: Segmentation Agent builds audiences

- Defines precise segments for each strategy

- Audience definitions ready to sync via Segment

Hour 5: Offers Agent designs interventions

- High-LTV: No discount, $15 shipping credit

- Mid-tier: Feature progression (no discounting)

- Price-sensitive: 10% bundle discount only

Hour 6: Playbook Agent creates execution briefs

- Complete campaign plans ready

- Messaging frameworks, channel strategies, timing

LAYER 2: Segment routes audiences (Activation)

- Syncs Niti AI-defined segments to Klaviyo, Braze

- Real-time audience updates

- Reliable delivery to execution tools

LAYER 3: Klaviyo/Braze execute campaigns

- Launch campaigns based on Niti AI playbooks

- Send emails, SMS, push notifications

- Execute at scale across channels

LAYER 4: Performance Agent learns

- Monitors results across all channels

- Identifies what worked (Strategy C: 19% success)

- Feeds learnings back to all agents

- Next week's strategies are 10-15% better

Total Time: 24 hours from detection to launch

Human Involvement: 30 minutes to review and approve strategies

The Stack Configurations: Three Models

Different companies need different combinations of these four layers.

Configuration A: "Complete Modern Stack"

For: Large enterprises, sophisticated brands

Stack:

- Layer 1: Fivetran (data collection)

- Layer 2: Segment (data unification)

- Layer 3: Hightouch (smart activation)

- Layer 4: Niti AI (strategic intelligence)

Monthly Investment: $20K-50K total

What You Get:

- Perfect data infrastructure

- Enterprise-grade governance

- Sophisticated activation

- Autonomous strategic intelligence

Best For:

- Enterprise brands ($100M+ revenue)

- Multi-brand organizations

- Complex data governance needs

- Teams ready for complete automation

Configuration B: "Mid-Market Efficiency Stack"

For: Growing DTC brands, mid-market companies

Stack:

- Layer 1: Rudderstack (cost-effective collection)

- Layer 2: Segment (proven unification)

- Layer 3: Klaviyo (e-commerce execution)

- Layer 4: Niti AI (strategic intelligence)

Monthly Investment: $8K-15K total

What You Get:

- Reliable data foundation

- E-commerce-native execution

- Strategic intelligence without expensive strategists

Best For:

- Mid-market DTC ($2-50M revenue)

- Shopify-based brands

- Resource-constrained teams

- Companies needing strategy generation

Configuration C: "Intelligence-First Stack"

For: Startups, focused brands with simple data needs

Stack:

- Layer 1: Native integrations (Shopify, basic tools)

- Layer 2: Shopify + basic CDP (sufficient at this scale)

- Layer 3: Klaviyo (e-commerce execution)

- Layer 4: Niti AI (strategic intelligence)

Monthly Investment: $5K-8K total

What You Get:

- Minimal infrastructure overhead

- Maximum strategic output

- Focus budget on intelligence, not pipes

Best For:

- Early-stage DTC brands ($2-10M revenue)

- Single-channel businesses

- Teams with limited technical resources

- Brands where strategy is the bottleneck

Why this works: At smaller scale, you don't need enterprise infrastructure. Shopify + Klaviyo provide sufficient data collection and execution. The bottleneck is strategic capacity—which is exactly what Layer 4 solves.

The Decision Framework: What Does Your Business Actually Need?

Question 1: Is your data infrastructure broken?

Symptoms:

- Customer data in 20+ disconnected tools

- Can't track customers across devices

- Data quality issues and inconsistencies

- Engineering bottlenecked on integrations

- Takes months to add new tools

If YES → Invest in Layers 1-2 first

- Fix: Implement Segment or mParticle

- Timeline: 3-6 months

- Investment: $50K-200K/year

- Result: Data infrastructure solved

If NO → Your infrastructure is fine, move to Question 2

Question 2: Can you execute campaigns effectively?

Symptoms:

- Hard to send multi-channel campaigns

- Can't automate customer journeys

- Limited by tool capabilities

- Poor execution monitoring

If YES (execution is broken) → Invest in Layer 3

- Fix: Upgrade to Klaviyo, Braze, or Hightouch

- Timeline: 1-3 months

- Investment: $20K-100K/year

- Result: Execution infrastructure solved

If NO → Your execution works fine, move to Question 3

Question 3: Do you know WHAT campaigns to run?

Symptoms:

- Running same generic playbooks quarterly

- Don't understand why customers churn

- Founders/marketers guessing at strategies

- Can't afford $150K strategists

- Only running 2-3 campaigns/week

- Over-discounting, eroding margins

- Want to optimize for profit, not just engagement

If YES (strategy is the bottleneck) → You need Layer 4

- Fix: Implement Niti AI

- Timeline: 2 weeks

- Investment: $15K-50K/year

- Result: Strategic intelligence automation

The Critical Insight:

Most mid-market brands have Questions 1-2 solved.

Their data flows. Their campaigns execute. Shopify + Klaviyo works fine at their scale.

Their bottleneck is Question 3: Strategic capacity.

They don't need better pipes. They need a brain.

This is why Layer 4 is the most valuable addition to the modern stack—it solves the problem infrastructure can't fix.

Common Stack Mistakes (And How to Avoid Them)

Mistake #1: "We need enterprise infrastructure"

The trap: Mid-market brands ($2-20M revenue) implement Segment + Hightouch + Snowflake because "that's what enterprises use."

The result:

- Spent $100K+ on infrastructure

- 6 months of implementation

- Data flows beautifully

- Still don't know what campaigns to run

- Still can't afford strategists

The fix: Infrastructure should match your scale. At $5M revenue, Shopify + Klaviyo is sufficient. Invest in Layer 4 (intelligence) instead of over-engineering Layers 1-2.

Better approach: Simple infrastructure + strategic intelligence

Mistake #2: "Tools will replace strategists"

The trap: Buying Klaviyo, Braze, or Hightouch expecting them to generate campaign strategies

The result:

- Tools work as designed (execute campaigns)

- But someone still needs to create the strategies

- End up hiring expensive strategists anyway

- Tools made strategists more efficient, didn't replace them

The fix: Understand the difference:

- Layer 3 tools help strategists execute faster

- Layer 4 intelligence replaces strategists entirely

Better approach: If you can't afford strategists, invest in Layer 4, not better Layer 3 tools

Mistake #3: "AI features in existing tools = AI workers"

The trap: Klaviyo adds "AI-powered send time optimization" → assume this solves strategic bottleneck

The result:

- AI features optimize tactics (when to send)

- Don't solve strategy (what to send, who to target, why they're churning)

- Still need humans for strategic thinking

The fix: Distinguish between:

- AI-enhanced tools (better execution) = Layer 3 evolution

- AI workers (strategy generation) = Layer 4 category

For detailed analysis of this distinction, see: Hightouch vs Niti AI: When Tools Meet Workers

Better approach: Don't confuse tactical AI features with strategic intelligence replacement

Mistake #4: "We'll build this in-house"

The trap: Engineering team says "We can build this ourselves—it's just some prompts and data science"

The reality:

- Reasoning engines are complex

- Causal inference requires specialized expertise

- Learning loops and feedback systems are non-trivial

- Maintenance burden is significant

- Time-to-value is 12-24 months

The economics:

- Build cost: $500K-1M (2 engineers, 1 data scientist, 18 months)

- Opportunity cost: Features not shipped

- Maintenance: Ongoing resource drain

vs. buying:

- $15K-50K/year

- 2-week deployment

- Continuously improving (you get model improvements)

The fix: Infrastructure is worth building. Intelligence is worth buying.

Build what differentiates your product. Buy what differentiates your growth.

Mistake #5: "Layer 4 replaces Layers 1-3"

The trap: Thinking strategic intelligence eliminates need for infrastructure

The reality: Layer 4 sits on top of infrastructure—it doesn't replace it.

Niti AI needs:

- Clean data (from Layers 1-2)

- Execution capabilities (Layer 3)

- Working infrastructure foundation

The fix: Think in layers, not replacements:

- Layers 1-2: Data foundation (required)

- Layer 3: Execution engine (required)

- Layer 4: Strategic brain (differentiator)

Better approach: Complete stack = all four layers working together

The Future: Where This Stack Is Heading

Trend 1: Infrastructure Commoditization

What's happening:

- CDPs becoming commodity (Segment competitors proliferate)

- Reverse ETL standardizing (Census, Hightouch converging)

- Data warehouses adding native activation

- Infrastructure pricing pressure

Implication: Don't over-invest in infrastructure. It's being commoditized. Differentiation is moving to Layer 4.

Trend 2: Intelligence Layer Expanding

What's coming: Beyond retention/growth strategies to:

- Product intelligence (what features to build)

- Pricing intelligence (optimal pricing strategies)

- Creative intelligence (what messaging resonates)

- Forecasting intelligence (predictive business planning)

Niti AI's roadmap: Starting with retention/growth (highest ROI, clearest value) → Expanding to adjacent strategic domains → Complete growth intelligence platform

Trend 3: Agent Architecture Standardization

What's emerging:

- Multi-agent systems becoming standard

- Specialized agents for specific jobs

- Human-in-the-loop approval workflows

- Learning loops and continuous improvement

Why this matters: "AI Workers" model (Niti AI's approach) becomes the standard for how companies buy strategic intelligence—not as tools, but as autonomous roles.

Trend 4: Vertical-Specific Intelligence

What's happening: Generic marketing tools → Vertical-specific solutions

Examples:

- E-commerce intelligence (Niti AI's current focus)

- SaaS intelligence (usage-based optimization)

- Gaming intelligence (engagement/monetization)

- Fintech intelligence (compliance + growth)

Why: Strategic intelligence requires domain expertise. Generic tools can't capture vertical-specific patterns.

Trend 5: Infrastructure + Intelligence Convergence

What might happen:

- Infrastructure platforms acquiring intelligence layers

- Intelligence platforms adding activation capabilities

- Eventual full-stack solutions

But near-term (2024-2027): Best-of-breed approach dominates. Companies prefer:

- Proven infrastructure (Segment/mParticle)

- Specialized intelligence (Niti AI)

- Working together via integrations

Why: Each layer requires different expertise. Infrastructure companies (data engineering focus) struggle to build intelligence. Intelligence companies focus on AI/strategy, partner for infrastructure.

For analysis of why infrastructure platforms like Hightouch are adding intelligence features but can't fully replace strategic intelligence layers, see: Hightouch vs Niti AI: When Tools Meet Workers

The Investment Roadmap: Sequence Matters

Phase 1: Foundation (Month 0-3)

Goal: Get data infrastructure working

Actions:

- Implement Layer 1 if needed (Fivetran/Rudderstack)

- Implement Layer 2 if needed (Segment/mParticle)

- Ensure data flowing to warehouse

- Verify data quality

Investment: $50K-150K setup + $5K-15K/month

Success Metric: Clean, unified customer data accessible

Phase 2: Execution (Month 3-6)

Goal: Enable multi-channel campaign execution

Actions:

- Implement Layer 3 (Klaviyo/Braze/Hightouch)

- Set up basic automation

- Configure channels (email, SMS, push)

- Test execution workflows

Investment: $20K-50K setup + $2K-8K/month

Success Metric: Can execute campaigns reliably across channels

Phase 3: Intelligence (Month 6-9) ← HIGHEST ROI

Goal: Automate strategy generation

Actions:

- Implement Layer 4 (Niti AI)

- 2-week onboarding

- First strategies generated

- Approval workflows established

Investment: $10K-20K setup + $1.5K-4K/month

Success Metric: 10+ strategies/week generated, approved, executed

Phase 4: Optimization (Month 9-12)

Goal: Continuous improvement and scaling

Actions:

- Tune learning loops

- Expand to new segments/use cases

- Optimize based on performance

- Scale successful patterns

Investment: No additional cost (included in Layer 4)

Success Metric: Each month's strategies 10-15% better than prior month

The Total Investment: Year 1

One-time costs: $80K-220K (infrastructure + setup)

Ongoing costs: $8.5K-27K/month ($100K-320K/year)

Compare to hiring:

- Data Analyst: $120K/year

- Growth Strategist: $150K/year

- Campaign Manager: $110K/year

- Total: $380K/year + benefits + hiring time

Result: Complete automated growth stack for ~same cost as hiring 3 people, but with:

- 10x output

- Zero turnover

- Continuous improvement

- Scalable instantly

Case Study: The Complete Stack in Action

Company: Mid-Market DTC Brand

Profile:

- $15M annual revenue

- 50K active customers

- Shopify + Klaviyo (Layer 3 working)

- Small team (founder + 2 marketers)

- No data analyst or strategist

The Problem:

Before complete stack:

- Founder spending 15 hours/week analyzing data

- Running same 3 campaigns quarterly

- Blanket 20% discounts eroding margins

- Don't understand why customers churn

- Want to hire strategist but can't find/afford

Infrastructure:

- Shopify provides basic data collection (Layer 1 sufficient)

- No CDP, but data flows to BigQuery (Layer 2 basic)

- Klaviyo executes campaigns (Layer 3 works)

- Missing: Strategic intelligence (Layer 4)

The Solution:

Month 1-2: Infrastructure Assessment

- Evaluated: Do we need Segment?

- Decision: No—Shopify + BigQuery sufficient at our scale

- Saved: $60K/year by not over-buying infrastructure

Month 3: Add Strategic Intelligence

- Implemented: Niti AI (Layer 4)

- Timeline: 2 weeks to deploy

- Investment: $3.5K/month

The Results (First 90 Days):

Strategic Output:

- Before: 3 campaigns/quarter (founder creating)

- After: 12 campaigns/month (AI workers generating)

- 4x increase in strategic output

Founder Time:

- Before: 15 hours/week on analysis + strategy

- After: 1 hour/week reviewing AI-generated strategies

- 15 hours/week freed for CEO work

Financial Impact:

- Margin erosion reduced: 20% discount rate → 14%

- Revenue maintained: $15M (growth continued)

- Margin preserved: $900K/year (6% of revenue)

- ROI: 257x first-year return on $3.5K/month investment

Campaign Quality:

- Before: Generic (one-size-fits-all)

- After: 5 distinct strategies per opportunity

- Margin-aware offers by segment

- Root cause-based approaches

The Stack Configuration:

Layer 1: Shopify native (sufficient)

Layer 2: BigQuery + basic setup (sufficient)

Layer 3: Klaviyo ($2K/month)

Layer 4: Niti AI ($3.5K/month)

Total monthly investment: $5.5K

vs. hiring strategist: $12K+/month

Key Insight: They didn't need enterprise infrastructure. They needed strategic intelligence on top of working (but simple) infrastructure.

This is the Intelligence-First Stack (Configuration C) in action.

Buyer's Checklist: Building Your Stack

✅ Layer 1: Data Collection

Do you need this if:

- Data in 10+ disconnected sources

- Need centralized data warehouse

- Want automated ETL

- Building analytics infrastructure

If NO to all: Skip Layer 1, use native platform integrations

If YES: Choose Fivetran (enterprise) or Rudderstack (developer-focused)

✅ Layer 2: Data Unification

Do you need this if:

- Customer data fragmented across tools

- Can't track customers across devices

- Need 50+ integrations

- Require governance/compliance

- Multi-brand organization

If NO to all: Skip Layer 2 at your current scale (Shopify + basic tools sufficient)

If YES: Choose Segment (market leader) or mParticle (enterprise governance)

For detailed analysis: Segment vs Niti AI: Infrastructure Meets Intelligence

✅ Layer 3: Execution & Activation

Do you need this if:

- Running marketing campaigns (everyone needs this)

- Multi-channel orchestration (email + SMS + push)

- Journey automation required

- Warehouse-native activation needed

If BASIC needs: Klaviyo (e-commerce) or similar simple platforms

If ADVANCED needs: Braze (enterprise orchestration) or Hightouch (warehouse-native + AI optimization)

For comparison of execution platforms: Hightouch vs Niti AI: When Tools Meet Workers

✅ Layer 4: Strategic Intelligence

Do you need this if:

- Can't afford $150K+ strategists

- Don't understand why customers churn

- Running <5 campaigns/week (should be 10+)

- Using generic playbooks

- Over-discounting, eroding margins

- Want to optimize for profit, not just engagement

- Founder/team doing strategy work (should focus elsewhere)

If YES to 2+: You need Layer 4 now

If YES to 5+: Layer 4 is your highest-ROI investment

Solution: Niti AI (category creator, only player in this space currently)

The Bottom Line: What Most Companies Actually Need

After analyzing hundreds of modern growth stacks, here's what we've learned:

80% of Mid-Market Brands ($2-50M Revenue):

Don't need: Enterprise infrastructure (Layer 1-2 overkill)

Have sufficient: Shopify + Klaviyo + basic tools (Layers 1-3 work)

Missing: Strategic intelligence (Layer 4 doesn't exist)

Their bottleneck: Not infrastructure. Not execution. Strategic capacity.

The solution: Add Layer 4 to existing stack

Investment: $15K-50K/year

Alternative: Hire strategists at $380K/year

ROI: 8-25x first year

20% of Enterprise Brands ($100M+ Revenue):

Need: Complete stack (all four layers)

Have budget for: $100K-500K/year total infrastructure

Want: Scalable, automated strategic intelligence

Their opportunity: Replace strategic labor with AI workers while maintaining enterprise infrastructure

The solution: Full stack (Fivetran + Segment + Hightouch + Niti AI)

Investment: $200K-500K/year

Alternative: Strategic team at $800K+/year

ROI: 2-4x ongoing, plus scalability

The Universal Truth:

Infrastructure (Layers 1-3) has been solved. Companies have invested billions. The pipes work. Data flows. Campaigns execute.

Intelligence (Layer 4) is the final frontier. After spending $100K-300K on infrastructure, companies still need expensive humans to figure out what to do.

This is the gap Niti AI fills.

Getting Started: Your 30-Day Action Plan

Week 1: Assess Your Current Stack

Day 1-2: Data Infrastructure Audit

- Map all data sources

- Identify where customer data lives

- Check: Can you track customers across devices?

- Verify: Is data accessible in warehouse or CDP?

- Decision: Layers 1-2 working or broken?

Day 3-4: Execution Infrastructure Audit

- List all marketing channels

- Check: Can you execute multi-channel campaigns?

- Verify: Is automation working?

- Review: Campaign execution speed and quality

- Decision: Layer 3 working or needs upgrade?

Day 5-7: Strategic Capacity Audit

- Count: How many campaigns/month are you running?

- Identify: Who creates campaign strategies?

- Calculate: Hours/week spent on strategy creation

- List: Strategic roles you wish you had

- Decision: Is Layer 4 your bottleneck?

Week 2: Prioritize Investments

Use this framework:

If Layers 1-2 broken: Fix infrastructure first

- Timeline: 3-6 months

- Investment: $50K-200K/year

- Priority: High (foundation required)

If Layer 3 broken: Upgrade execution second

- Timeline: 1-3 months

- Investment: $20K-100K/year

- Priority: Medium (need working execution)

If Layers 1-3 working but no strategic capacity: Add Layer 4

- Timeline: 2 weeks

- Investment: $15K-50K/year

- Priority: Highest ROI (bottleneck removal)

Most mid-market companies: Jump straight to Layer 4

Week 3: Vendor Evaluation

For Layer 4 (Strategic Intelligence):

Schedule Niti AI demo:

- See: Six AI workers in action

- Watch: Strategy generation from your data type

- Review: Causal reasoning examples

- Understand: Margin-aware optimization approach

Evaluation criteria:

- Can they analyze why customers behave? (causal reasoning)

- Do they generate complete strategies? (not just optimization)

- Is margin/profit optimization built-in?

- Does it replace strategic labor? (not just assist)

- Can they deploy in 2 weeks?

- Do strategies improve over time? (learning loops)

Red flags:

- ❌ Just another dashboard

- ❌ Only optimizes existing campaigns (Layer 3, not Layer 4)

- ❌ Requires data science team to operate

- ❌ Can't explain reasoning (black box)

Week 4: Business Case & Decision

Calculate your ROI:

Current strategic labor cost:

- Analyst: $_____/year (or founder time equivalent)

- Strategist: $_____/year (or time you wish you had)

- Campaign Manager: $_____/year

- Total: $_____/year

Layer 4 investment:

- Niti AI: $15K-50K/year

- Setup time: 2 weeks

- Payback: 1-3 months

Expected outcomes:

- Strategic output: 4-10x increase

- Margin preserved: 3-6% of revenue

- Time freed: 15-30 hours/week for leadership

- Campaign quality: Causal, segmented, margin-aware

Make decision:

- Business case approved

- Budget allocated

- Timeline set

- Implementation begins

Conclusion: The Intelligence Era Is Here

The complete growth stack in 2026 has four layers, not three.

We spent the last decade building perfect infrastructure:

- Data collection: Solved

- Data unification: Solved

- Execution automation: Solved

We're now entering the intelligence era:

- Strategy generation: Being solved

- Causal reasoning: Being solved

- Margin optimization: Being solved

- Labor replacement: Being solved

Niti AI is creating Layer 4: Strategic Intelligence as a Service

This isn't just another tool category. It's a fundamental rethinking of what technology should do:

From: Tools that help humans work faster

To: AI workers that replace strategic labor entirely

From: Infrastructure that moves data

To: Intelligence that decides what to do with data

From: Platforms requiring strategists

To: Autonomous agents that are the strategists

The Choice Every Company Faces:

Keep hiring expensive strategists ($380K+/year, 12+ months to build team, turnover risk)

Or adopt AI workers ($15K-50K/year, 2 weeks to deploy, continuous improvement)

Keep running generic campaigns (2-3/quarter, blanket discounting, margin erosion)

Or generate sophisticated strategies (10+/week, segment-specific, margin-aware)

Keep infrastructure without intelligence (perfect pipes, no brain)

Or complete the stack (infrastructure + intelligence working together)

The infrastructure era gave us the foundation.

The intelligence era gives us the decisions.

Welcome to Layer 4.

Additional Resources

Deep-Dive Articles:

📄 Segment vs Niti AI: When Infrastructure Meets Intelligence Detailed analysis of the CDP infrastructure layer and where strategic intelligence fits

📄 Hightouch vs Niti AI: When Tools Meet Workers Understanding the difference between execution optimization and strategy generation

📄 The Complete Guide to Agentic Growth Strategists How AI workers are replacing traditional marketing roles

Implementation Guides:

🛠️ Building Your Strategic Intelligence Layer (Coming Soon)

🛠️ Migrating from Human Strategists to AI Workers (Coming Soon)

🛠️ ROI Calculator: Strategic Intelligence Investment (Coming Soon)

Ready to complete your growth stack?

[Schedule a demo] to see Layer 4 (Strategic Intelligence) in action—watch Niti AI's six AI workers generate strategies from your data in hours, not weeks.

Or keep hoping your expensive infrastructure will somehow generate strategies on its own.

The infrastructure era is over.

The intelligence era is here.

Complete your stack.