Segment vs Niti AI: When Infrastructure Meets Intelligence

Five years ago, Segment solved marketing's hardest infrastructure problem.

They got customer data out of silos. They created a single source of truth. They made it possible to collect once, send everywhere—across 450+ destinations, in real-time, with perfect reliability.

Today, 25,000+ companies use Segment. The pipes work. The data flows. Customer profiles are unified.

But after your data is unified... what do you actually do with it?

This is the question that keeps CMOs awake at night. You've spent $100K+ on Segment. Your data infrastructure is world-class. Events flow perfectly from your app to your warehouse to every tool in your stack.

And yet—your marketing team is still drowning.

They're staring at unified customer profiles, trying to figure out:

- Why is this cohort churning?

- Which customers should we target?

- What campaigns should we run?

- How do we optimize for profit, not just engagement?

Segment doesn't answer these questions. Because Segment is infrastructure, not intelligence.

The Infrastructure vs. Intelligence Divide

Let's be clear about what we're comparing:

Segment asks: "How do we collect customer data from every source and route it to every destination, reliably at scale?"

Niti AI asks: "How do we analyze that data to generate the strategic campaigns that drive profitable growth?"

Different problems. Different solutions. Different categories.

Think of it this way:

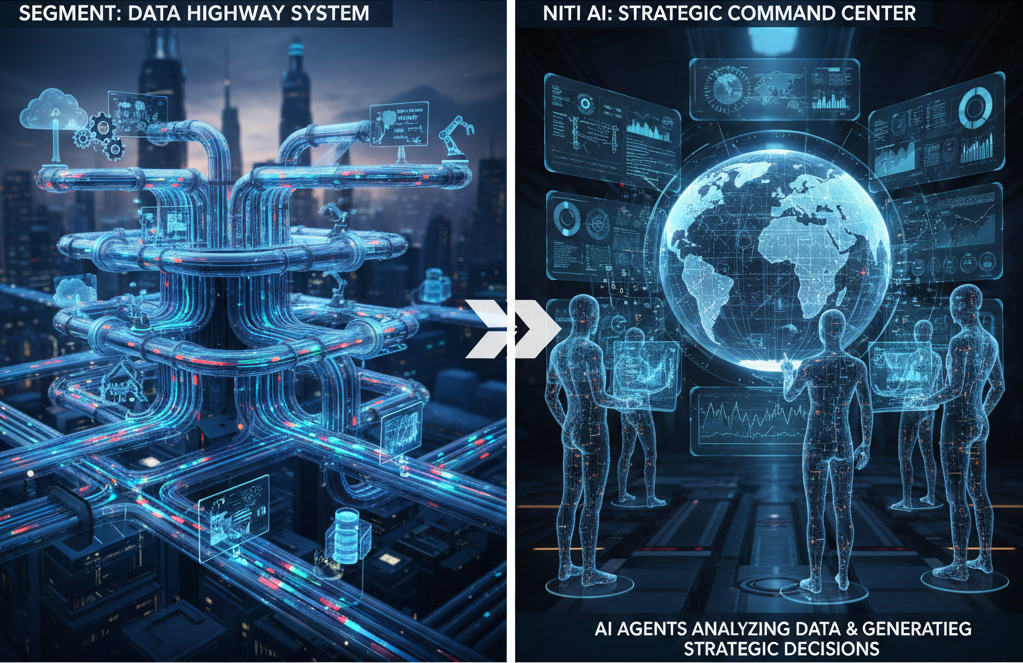

Segment is Your Data Highway System

It's the infrastructure that moves customer data from point A to point B with perfect reliability:

- Collect events from web, mobile, server, cloud apps

- Unify customer identities across devices and platforms

- Route data to 450+ destinations in real-time

- Ensure data quality, governance, and compliance

- Provide warehouse-first architecture

Segment excels at the "plumbing."

Niti AI is Your Strategic Intelligence Layer

It's the decision-making system that determines what to do with that data:

- Analyze customer behavior to identify why patterns exist (causal reasoning)

- Generate campaign strategies based on root cause analysis

- Design margin-aware offers that preserve profitability

- Build precise segments optimized for business outcomes

- Create execution-ready playbooks automatically

- Learn from results and regenerate improved strategies

Niti AI excels at the "thinking."

One moves data. The other decides what to do with it.

One is infrastructure. The other is intelligence.

What Segment Solved (And Did Brilliantly)

To understand why you need both infrastructure and intelligence, let's first appreciate what Segment actually does—and why it was revolutionary.

The Problem Before Segment (2011-2015):

Data Chaos:

- Every marketing tool had its own tracking code

- Customer data lived in 20+ disconnected silos

- No single view of the customer

- Analytics said one thing, email tool said another

- Changing tools meant reimplementing tracking everywhere

Developer Hell:

- Engineering team spent weeks implementing new tools

- Each tool required custom integration

- Maintaining tracking code became a nightmare

- Marketing couldn't move fast because engineering was bottlenecked

What Segment Solved:

1. Single Integration Point

- Implement Segment once

- Connect to 450+ tools instantly

- Add/remove tools without code changes

- Marketing moves fast, engineering stays sane

2. Customer Identity Resolution

- Unify anonymous visitors → identified users

- Track across devices (mobile app, web, email)

- Resolve identities across platforms

- Single customer profile

3. Data Quality & Governance

- Schema validation

- Data quality rules

- Compliance controls (GDPR, CCPA)

- Audit trails

4. Real-Time Activation

- Events flow to destinations instantly

- No batch delays

- Live customer data everywhere

- Consistent data across stack

5. Warehouse-First Architecture

- Your data stays in your warehouse

- Segment doesn't lock you in

- Own your data completely

- Modern composable approach

Why This Was Revolutionary:

Before Segment, companies spent:

- 6-12 months integrating marketing tools

- $500K+ in engineering time

- Ongoing maintenance hell

After Segment, companies spend:

- 2-4 weeks connecting everything

- $50K+ in Segment subscription

- Zero ongoing integration work

This is genuine value. Segment earned its $3.2B acquisition.

What Segment Doesn't Do (By Design)

Here's what often surprises companies after they implement Segment:

Segment Tells You What Happened

- Customer viewed Product A

- Customer added to cart

- Customer purchased $127

- Customer opened email

- Customer churned

Segment Doesn't Tell You Why

- Why did this cohort convert better than that cohort?

- Why are customers churning after 90 days?

- Why do some products drive repeat purchases while others don't?

This isn't a criticism—it's by design. Segment is data infrastructure, not a business intelligence tool.

Segment Routes Data Where You Tell It

- Send purchase events to Klaviyo

- Send page views to Google Analytics

- Send user profiles to Salesforce

- Send everything to your warehouse

Segment Doesn't Decide What To Do

- Which customers should receive which campaigns?

- What offers preserve margin while driving action?

- Which segments are worth targeting?

- What strategies address root causes vs. symptoms?

Again, by design. Segment moves data; it doesn't make strategic decisions.

Segment Unifies Customer Records

- Alice on mobile = Alice on web = Alice in email

- Perfect identity resolution

- Single customer view

Segment Doesn't Generate Customer Strategies

- What campaign should we run for Alice?

- What's causing Alice to disengage?

- What offer would bring Alice back without eroding margin?

- How do we prevent more customers like Alice from churning?

This is the infrastructure vs. intelligence gap.

The "Segment + Human Strategist" Problem

After implementing Segment, most companies realize they still need someone to:

1. Analyze the Unified Data (15-20 hours/week)

- Query the warehouse Segment populates

- Build cohort analyses

- Try to identify patterns

- Create dashboards

2. Generate Strategic Insights (10-15 hours/week)

- Interpret what the data means

- Identify opportunities

- Develop hypotheses about customer behavior

- Prioritize what to act on

3. Design Campaign Strategies (10-15 hours/week)

- Brainstorm campaign approaches

- Decide on targeting criteria

- Design offer structures

- Create execution plans

4. Build Segments & Execute (10-12 hours/week)

- Define audiences in downstream tools

- Coordinate across channels

- Launch campaigns

- Monitor performance

Total: 45-62 hours per week of strategic thinking

This is why companies hire:

- Data Analysts ($120K/year)

- Growth Strategists ($150K/year)

- Campaign Managers ($110K/year)

Cost: $380K+/year in human labor

Segment solved the infrastructure. But you still need expensive humans to figure out what to do with that infrastructure.

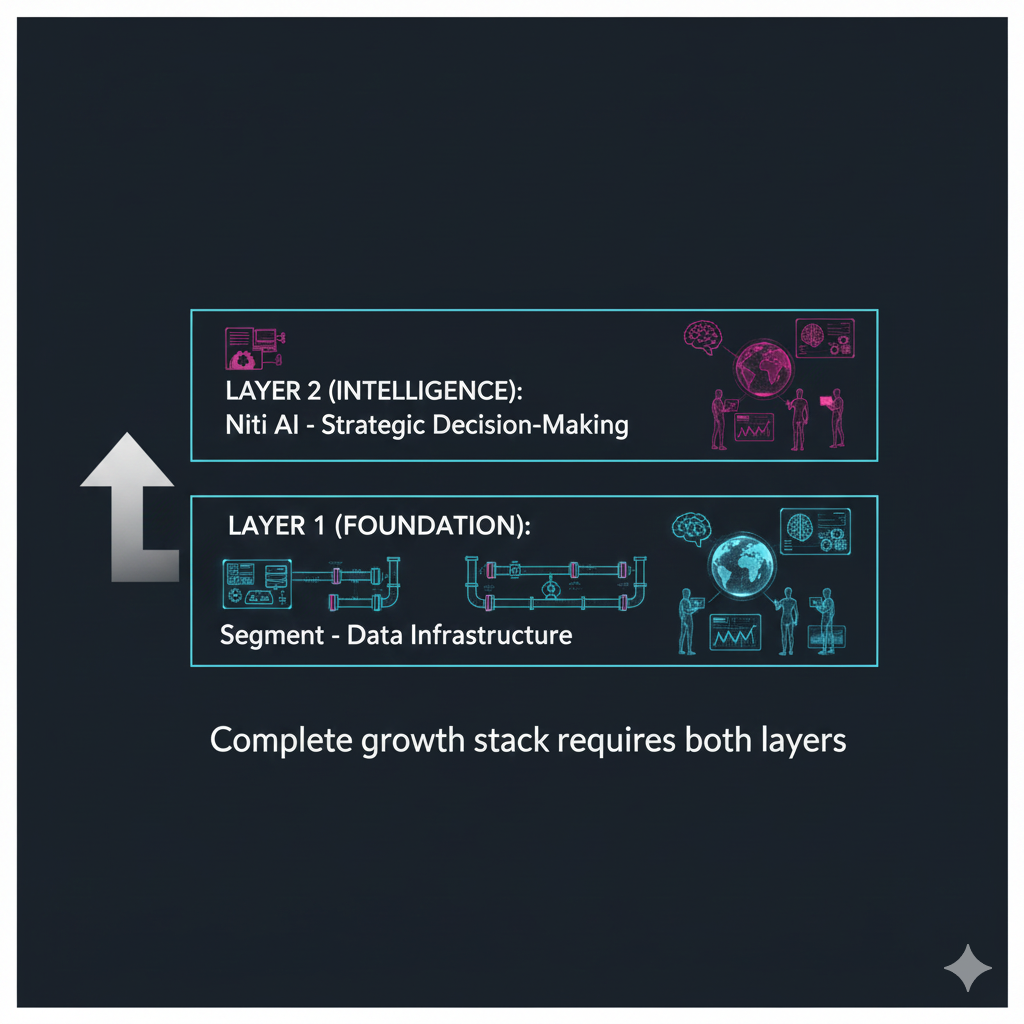

Where Niti AI Fits: The Intelligence Layer

While Segment provides the data foundation, Niti AI provides the strategic intelligence that foundation enables.

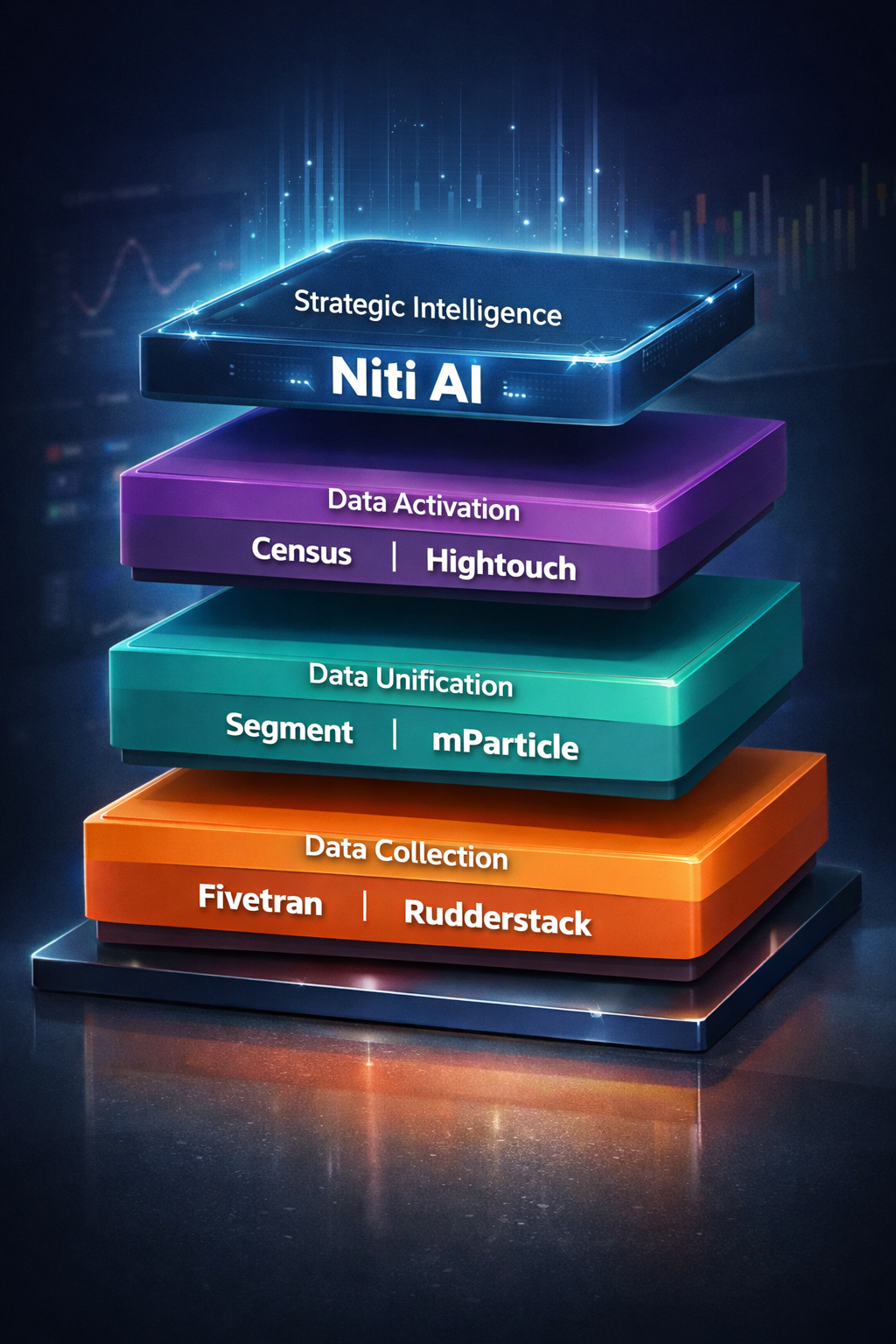

The Architecture:

┌─────────────────────────────────────────┐

│ DATA SOURCES │

│ (Web, Mobile, Server, Cloud Apps) │

└─────────────────────────────────────────┘

↓

┌───────────────────────┐

│ SEGMENT │

│ (Infrastructure) │

│ • Collect │

│ • Unify │

│ • Route │

│ • Ensure Quality │

└───────────────────────┘

↓

┌───────────────────────┐

│ DATA WAREHOUSE │

│ (Single Source of │

│ Truth) │

└───────────────────────┘

↓

┌───────────────────────┐

│ NITI AI │

│ (Intelligence) │

│ • Analyze Why │

│ • Generate Strategy │

│ • Design Offers │

│ • Create Playbooks │

└───────────────────────┘

↓

┌─────────────────────────────────────────┐

│ EXECUTION TOOLS │

│ (Klaviyo, Braze, Salesforce, etc.) │

└─────────────────────────────────────────┘

Segment handles layers 1-3 (collection, routing, storage)

Niti AI handles layer 4 (strategic decision-making)

The Six AI Workers That Replace Strategic Labor

Instead of hiring expensive humans to analyze Segment data, Niti AI provides autonomous agents:

[Image suggestion: Hexagonal diagram showing six interconnected AI agents forming a unified intelligence system]

1. Insights Agent – Replaces Data Analyst

- Continuously analyzes customer behavior in your warehouse

- Performs causal analysis (not just correlation)

- Identifies why customers behave certain ways

- Surfaces high-impact opportunities with quantified business value

Example Output:

"Customers who experienced delayed shipments are churning at 3.2x normal rates (2,341 customers affected, $47K/month margin at risk). Root cause: operational failure breaking trust, not product satisfaction issues."

2. Strategy Agent – Replaces Growth Strategist

- Generates complete campaign strategies based on root causes

- Creates 3-5 MECE (mutually exclusive, collectively exhaustive) approaches

- Designs strategies by segment, not generic playbooks

- Considers business constraints, competitive context, seasonality

Example Output:

"Strategy A: Operational Trust Recovery (target shipping-delayed customers with service guarantees, not discounts). Strategy B: Activation Acceleration (target incomplete-setup customers with guided onboarding). Strategy C: Discovery Expansion (target single-item buyers with smart bundles)."

3. Segmentation Agent – Replaces Segmentation Specialist

- Builds precise, multi-dimensional customer segments

- Incorporates lifecycle stage, product affinity, margin contribution, behavior

- Creates dynamic segments that evolve with customer actions

- Ensures segments are mutually exclusive and actionable

Example Output:

"Segment 1: High-LTV shipping-delayed (2,341 customers, avg margin $87, 85% retention probability with intervention). Segment 2: Mid-tier incomplete-setup (5,892 customers, avg margin $34, 65% retention probability). Segment 3: Price-sensitive single-item (8,105 customers, avg margin $12, 40% retention probability)."

4. Offers Agent – Replaces Pricing Strategist

- Designs margin-aware intervention strategies

- Optimizes offer structures for profitability AND conversion

- Personalizes incentives by customer value and price sensitivity

- Prevents over-discounting through intelligent targeting

Example Output:

"High-LTV: No discount (training bad behavior), offer $15 expedited shipping credit ($150 margin preserved). Mid-tier: Feature unlocking progression (no discounting, increases stickiness). Price-sensitive: Strategic 10% bundle discount (AOV increase > discount cost)."

5. Playbook Agent – Replaces Campaign Manager

- Generates execution-ready campaign briefs

- Produces messaging frameworks, channel strategies, timing plans

- Creates testing approaches and success metrics

- Provides step-by-step implementation guidance

Example Output:

"Segment 1 Campaign: Email subject lines (3 variants), SMS follow-up (48hr), channel sequence (email→SMS→push), success metrics (12% reactivation target, 15% margin preservation), audience refresh (daily via Segment)."

6. Performance Agent – Replaces Performance Analyst

- Monitors campaign outcomes in real-time

- Conducts post-campaign learning capture

- Feeds insights back to all agents for strategy refinement

- Tracks margin impact and true ROI, not just engagement

Example Output:

"Strategy A exceeded projections: 14% reactivation at +$11 margin/customer. Strategy B underperformed: 6% reactivation (shipping credit too generic—recommend product-specific credits). Strategy C highest ROI: bundle upsells drove 23% AOV increase. Regenerating next week's strategies with these learnings."

The Scenario: Infrastructure + Humans vs. Infrastructure + Intelligence

Let's make this concrete. Your data team notices churn spiking 15% in Q4.

With Segment + Human Team:

Week 1 – Human Analysis (Using Segment Data):

- Data analyst queries warehouse populated by Segment

- Spends 20 hours building cohort analyses

- Identifies at-risk customer patterns

- Creates "high churn risk" definition

- Presents findings to growth team

Week 2 – Human Strategy (Based on Segment Data):

- Growth strategist reviews analyst's work

- Brainstorms campaign approaches

- Decides: "Send 20% discount to at-risk customers"

- Designs single generic strategy

Week 2-3 – Human Execution (Using Segment-Routed Data):

- Campaign manager builds segments in tools

- Segment ensures data syncs perfectly to execution platforms

- Coordinates email + SMS campaigns

- Launches after QA

Week 4 – Human Analysis (Measuring Segment-Tracked Events):

- Analyst pulls performance data (routed via Segment)

- Builds dashboards

- Reports results

Result after 30 days:

- ✓ Segment infrastructure worked perfectly (data flowed reliably)

- ✓ Reduced churn by 8%

- ✗ Single generic strategy (blanket 20% discount)

- ✗ No root cause understanding

- ✗ High-value customers got unnecessary discounts (margin erosion)

- ✗ 3-4 weeks from detection to launch

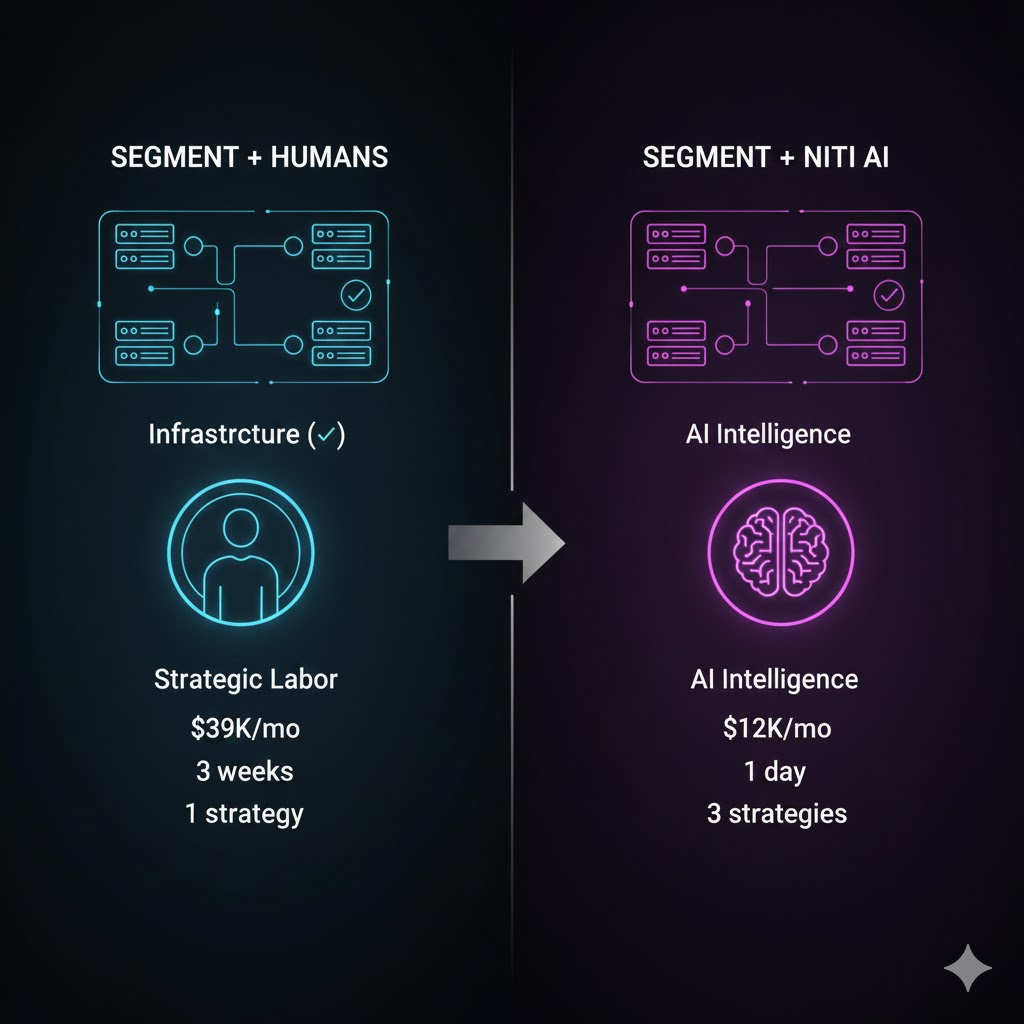

Total Cost:

- Segment: $8K/month

- Data Analyst: $10K/month

- Growth Strategist: $12K/month

- Campaign Manager: $9K/month

- Total: $39K/month

What Segment provided: Perfect data infrastructure

What still required humans: All strategic thinking

With Segment + Niti AI:

Monday 9 AM – Insights Agent Analyzes (Segment Data):

- Accesses warehouse Segment populates

- Analyzes 100+ customer behavior features

- Performs causal analysis (2 hours, autonomous)

- Discovers root causes:

- Delayed shipments → 3.2x churn (2,341 customers)

- Incomplete setup → 2.8x churn (5,892 customers)

- Single-item purchases → 2.1x churn (8,105 customers)

- Quantifies: $47K/month margin at risk

Monday 11 AM – Strategy Agent Generates (3 strategies, 1 hour):

- Strategy A: Operational Trust Recovery

- Strategy B: Activation Acceleration

- Strategy C: Discovery Expansion

Monday 12 PM – Segmentation Agent Builds (30 min):

- Creates three precise audience definitions

- Segment will sync these audiences to execution tools

Monday 1 PM – Offers Agent Designs (1 hour):

- High-LTV: $15 shipping credit, no discount (margin preserved)

- Mid-tier: Feature progression, no discounting (stickiness increased)

- Price-sensitive: 10% bundle discount (AOV increase > cost)

Monday 2 PM – Playbook Agent Creates (1 hour):

- Complete execution briefs for all three campaigns

- Channel strategies, messaging frameworks, timing plans

- Segment will ensure data flows to execution perfectly

Monday 3 PM – You Review (30 minutes):

- All strategy work complete

- You approve or modify

- Execution team launches

Monday 4 PM – Tuesday:

- Team executes in existing tools (Klaviyo, Braze, etc.)

- Segment ensures data syncs reliably

- Campaigns launch 24 hours after detection

Days 2-30 – Performance Agent Monitors:

- Tracks outcomes using Segment-routed data

- Strategy A: 14% reactivation, +$11 margin

- Strategy B: 8% reactivation, +$6 margin

- Strategy C: 19% bundle adoption, +$18 margin

- Feeds learnings back for next week

Result after 30 days:

- ✓ Segment infrastructure worked perfectly (as always)

- ✓ Churn reduced by 13% (better than generic approach)

- ✓ Margin increased by 9% (smart targeting)

- ✓ Root cause understanding documented

- ✓ Three differentiated strategies

- ✓ 1 day from detection to launch

- ✓ Continuous improvement (weekly strategy regeneration)

Total Cost:

- Segment: $8K/month

- Niti AI: $4K/month

- Total: $12K/month

- Savings: $27K/month vs. human team

What Segment provided: Perfect data infrastructure (unchanged)

What Niti AI provided: All the strategic thinking humans used to do

This Is The Difference

Let's be explicit:

Segment's infrastructure worked perfectly in both scenarios. Data collection was flawless. Identity resolution was accurate. Warehouse population was real-time. Destination syncing was reliable.

But infrastructure alone doesn't answer:

- Why are customers churning?

- Which strategies address root causes?

- What offers preserve margin?

- How should we differentiate by segment?

That's because infrastructure doesn't think. It moves data.

With humans, you spent $27K/month on strategic labor to figure out what to do with Segment's data.

With Niti AI, you get that strategic thinking for $4K/month—delivered in hours, not weeks, with multiple strategies, not one generic approach.

Same infrastructure. Different intelligence layer.

The Integration: How Segment + Niti AI Work Together

For brands serious about growth, the answer isn't Segment OR Niti AI—it's both.

The Data Flow:

1. Segment Collects & Unifies (What it does best):

- Events from web, mobile, server

- Identity resolution across devices

- Unified customer profiles

- Real-time warehouse population

2. Niti AI Analyzes & Strategizes (What we do best):

- Access unified data in warehouse

- Perform causal analysis (why patterns exist)

- Generate campaign strategies

- Design margin-aware offers

- Create execution playbooks

3. Segment Routes & Activates (Back to infrastructure):

- Sync Niti AI-defined audiences to execution tools

- Ensure reliable delivery across channels

- Track events from campaigns

- Feed results back to warehouse

4. Niti AI Learns & Improves (Intelligence loop):

- Performance Agent analyzes outcomes

- Identifies what worked, what didn't

- Regenerates improved strategies

- Continuous optimization

The Symbiosis:

World-class infrastructure (Segment) meets world-class intelligence (Niti AI).

- Segment ensures your data is collected, unified, and routed perfectly

- Niti AI ensures you know what campaigns to run with that data

- Segment activates the strategies Niti AI generates

- Niti AI learns from the results Segment tracks

Together, they create an autonomous growth engine:

- Data flows reliably (Segment)

- Strategies generate continuously (Niti AI)

- Campaigns activate automatically (Segment)

- Intelligence improves systematically (Niti AI)

When You Need Segment vs. When You Need Niti AI

You Need Segment If:

Your data infrastructure is broken:

- Customer data trapped in 20+ silos

- No single source of truth

- Engineering team bottlenecked on integrations

- Inconsistent data across tools

- Can't track customers across devices

- Changing tools takes months

Segment solves: Data chaos, integration hell, identity resolution

You Need Niti AI If:

Your strategy generation is broken:

- Data is unified but nobody knows what it means

- Founders/marketers guessing at campaigns

- Can't afford $150K strategists

- Generic playbooks not working

- Running 2-3 campaigns/week (should be 10+)

- Over-discounting and eroding margins

Niti AI solves: Strategic bottleneck, expensive labor, generic campaigns

You Need BOTH If:

You're serious about scalable, profitable growth:

- Want perfect data infrastructure AND strategic intelligence

- Ready to eliminate strategic labor bottleneck

- Need to run sophisticated campaigns at scale

- Want margin-aware optimization, not just engagement

- Serious about continuous improvement and learning loops

Together they solve: Complete growth infrastructure from data to decisions

What Segment Does Better Than Anyone

Let's be intellectually honest about Segment's strengths:

1. Data Collection Infrastructure

- 450+ pre-built source integrations

- SDKs for web, mobile, server (battle-tested)

- Event tracking that "just works"

- Schema validation and data quality rules

2. Identity Resolution

- Best-in-class cross-device tracking

- Anonymous → identified user resolution

- Handles complex identity graphs

- Proven at massive scale

3. Destination Routing

- 450+ destination integrations

- Real-time data activation

- Reliable delivery guarantees

- Flexible routing rules

4. Enterprise Governance

- GDPR/CCPA compliance built-in

- Data governance controls

- Audit trails and monitoring

- Role-based access control

5. Ecosystem & Scale

- 25,000+ customers

- $3.2B Twilio acquisition validates category

- Massive developer community

- Proven at enterprise scale

These are real strengths. If your data infrastructure is chaos, Segment is exceptional at bringing order.

What Niti AI Does That Segment Doesn't

1. Causal Analysis (Not Just Data Collection)

- Segment: Tracks what happened (customer churned)

- Niti AI: Explains why it happened (delayed shipment broke trust)

2. Strategy Generation (Not Just Data Routing)

- Segment: Routes data to tools you specify

- Niti AI: Generates the campaigns you should run

3. Margin-Aware Optimization

- Segment: Agnostic to business outcomes (just moves data)

- Niti AI: Optimizes for profit, not just engagement

4. Autonomous Intelligence

- Segment: Requires humans to interpret data

- Niti AI: AI workers do the interpretation

5. Continuous Strategy Improvement

- Segment: Infrastructure doesn't learn (it executes reliably)

- Niti AI: Agents learn from outcomes and regenerate better strategies

The Category Positioning

Segment and Niti AI operate in different categories:

Segment Created: "Customer Data Infrastructure"

Problem Statement:

"Customer data is trapped in silos, we need a single source of truth."

Solution:

Composable CDP that collects, unifies, and routes customer data

Category:

Infrastructure / Data platform

Buyer:

Data teams, engineering, IT

Success Metric:

Data quality, integration completeness, uptime

Niti AI Is Creating: "AI Workers for Growth"

Problem Statement:

"We have unified data but can't afford strategists to figure out what to do with it."

Solution:

Autonomous AI agents that generate campaign strategies and optimize for profit

Category:

Strategic intelligence / Labor replacement

Buyer:

CMO, CFO, growth leaders

Success Metric:

Strategies generated, margin preserved, time saved

Different problems. Different solutions. Different categories.

When prospects ask: "What's the difference between Segment and Niti AI?"

Answer:

"Segment ensures your customer data is collected, unified, and accessible—solving your infrastructure problem. Niti AI ensures you know what campaigns to run with that data—solving your strategic intelligence problem. Most companies need both: Segment for the foundation, Niti AI for the decisions."

The Real Question: What's Your Bottleneck?

Strip away the features and positioning. Ask yourself:

"Why aren't we running more sophisticated retention campaigns?"

If your answer is:

"Our data is a mess—we can't even track customers reliably"

→ You need Segment

Your tracking is broken. Data is in silos. You don't have a unified view. Engineering is drowning in integration requests.

Fix this first. Without reliable data infrastructure, nothing else matters.

If your answer is:

"Our data is fine, we just don't know what campaigns to run or why customers are leaving"

→ You need Niti AI

Segment already solved your infrastructure problem (or you have equivalent). Your bottleneck is strategic: nobody has time to analyze the data, generate strategies, design offers, build segments.

This is the intelligence gap. You have the foundation but no brain using it.

If your answer is:

"Both—our data is messy AND we lack strategic capacity"

→ You need Segment first, then Niti AI

Fix infrastructure before adding intelligence. Clean data is a prerequisite for smart strategies.

Sequence matters: Foundation first, intelligence second.

The Honest Truth for Most Mid-Market Brands:

Their data infrastructure is "good enough."

They use Segment (or have Shopify + basic tools that work). Events flow. Customer records exist. Data gets to the right places.

Their strategic capacity is NOT good enough.

They're running the same generic campaigns every quarter. Founders are guessing. They want to hire strategists but can't afford $150K salaries. They're leaving growth on the table.

This is where Niti AI fits.

You don't need better pipes. You need a brain.

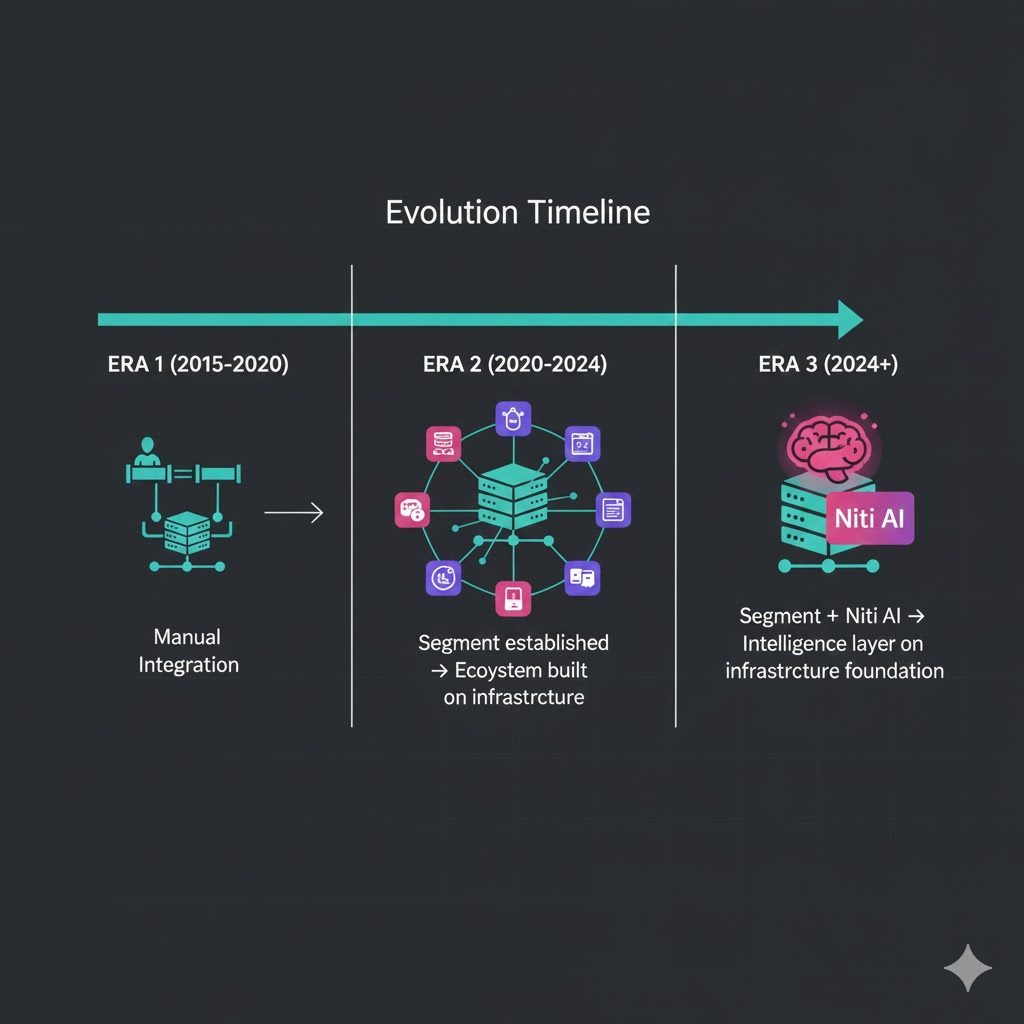

Why This Matters Now: The Infrastructure Era Is Over

For the past decade, marketing technology focused on infrastructure:

2015-2020: The CDP Era

- Solve data silos (Segment wins)

- Unify customer profiles (mParticle, Treasure Data)

- Warehouse as CDP (Segment wins again with Protocols)

2020-2024: The Activation Era

- Reverse ETL (Hightouch, Census)

- Real-time activation (Segment continues dominance)

- Composable architecture (everyone pivots to warehouse-native)

The pattern: Build better pipes, faster syncs, cleaner data.

The result: We have amazing infrastructure. Most mid-market brands have solved data collection and routing.

What's Still Broken: The Intelligence Gap

After spending $100K+ on data infrastructure, CMOs realize:

Nobody is analyzing the data strategically. Nobody is generating campaign ideas. Nobody is designing margin-aware offers. Nobody is building sophisticated segments.

The infrastructure works. The thinking doesn't exist.

This is the paradigm shift:

From "How do we collect and route data?" (solved)

To "How do we decide what to do with that data?" (unsolved)

From infrastructure as the bottleneck (Segment era)

To intelligence as the bottleneck (Niti AI era)

The Next Decade: AI Workers Replace Strategic Labor

Just as Segment replaced infrastructure labor (engineers manually integrating tools), Niti AI replaces strategic labor (analysts and strategists manually creating campaigns).

The pattern repeats:

Then (2015):

- Companies hired engineers to build data integrations

- Segment said: "We'll do that for you"

- Labor replaced by infrastructure

Now (2025):

- Companies hire strategists to analyze data and create campaigns

- Niti AI says: "We'll do that for you"

- Labor replaced by intelligence

This is the category shift.

Infrastructure is solved. Intelligence is the new frontier.

Ready to Add Intelligence to Your Infrastructure?

If you're using Segment (or equivalent infrastructure):

Your data collection is solved. Your customer profiles are unified. Your destinations are connected.

The missing piece is strategic intelligence:

- Someone (or something) to analyze why customers behave

- Generate campaigns that address root causes

- Design offers that preserve margin

- Create strategies continuously, not quarterly

- Learn from results and improve

This is what Niti AI adds to your Segment infrastructure.

[Schedule a demo] to see how Niti AI's six AI workers generate strategies from your Segment-unified data—producing in hours what would take human strategists weeks, at 1/10th the cost.

Or keep hiring expensive analysts to figure out what your perfect infrastructure is telling you.

The infrastructure era is over.

The intelligence era is here.

Segment got you to the starting line.

Niti AI runs the race.

Appendix: How Niti AI Compares to Other Infrastructure Platforms

While Segment is the category leader in customer data infrastructure, several other platforms solve similar problems. Here's how Niti AI compares to each.

A1. mParticle vs. Niti AI

What mParticle Is:

Core Focus: Enterprise customer data platform with emphasis on data quality and governance

Key Capabilities:

- Real-time customer data infrastructure

- Data quality management and validation

- Multi-channel attribution

- Audience segmentation and activation

- Privacy and consent management

- 300+ integrations

Ideal Customer:

- Enterprise brands ($100M+ revenue)

- Multi-brand organizations

- Companies with complex governance needs

- IT/data team buyers

Pricing: $100K-300K+/year (enterprise-focused)

What mParticle Does Well:

1. Data Quality Controls

- Schema enforcement

- Real-time data validation

- Quality scoring

- Anomaly detection

2. Enterprise Governance

- Advanced privacy controls

- Consent management

- Data residency options

- Compliance automation (GDPR, CCPA)

3. Predictive Analytics

- Calculated attributes (CLV, propensity scores)

- Audience predictions

- Basic ML models

4. Multi-Brand Management

- Manage multiple brands in single platform

- Cross-brand data governance

- Shared and isolated audiences

What mParticle Doesn't Do:

Strategic Intelligence Gap:

Like Segment, mParticle is infrastructure—not strategic intelligence:

- ❌ No causal analysis: Tells you what happened, not why

- ❌ No strategy generation: Doesn't create campaign approaches

- ❌ No margin optimization: No financial awareness in targeting

- ❌ No autonomous execution: Requires humans to build campaigns

- ❌ No learning loops: Infrastructure doesn't improve strategically

After implementing mParticle, you still need:

- Data analysts to interpret the data

- Growth strategists to generate campaigns

- Campaign managers to execute

- Performance analysts to optimize

The mParticle + Niti AI Combination:

mParticle provides:

- Enterprise-grade data infrastructure

- Real-time data quality management

- Cross-brand governance

- Compliance automation

Niti AI adds:

- Causal analysis of mParticle-unified data

- Strategy generation based on patterns

- Margin-aware campaign optimization

- Autonomous AI workers replacing strategic labor

Who needs both:

- Enterprise multi-brand organizations

- Companies with complex governance (healthcare, finance)

- Brands needing both data quality AND strategic intelligence

Who needs just Niti AI:

- Mid-market brands ($2-50M) without complex governance

- Single-brand DTC companies

- Teams using Shopify + basic tools (sufficient infrastructure)

Key Comparison:

| Dimension | mParticle | Niti AI |

|---|---|---|

| Category | Data infrastructure | Strategic intelligence |

| Core Value | Unified, quality data | Campaign strategies |

| Primary Job | Collect, validate, route | Analyze, strategize, optimize |

| Data Quality | ✅ Advanced | Standard |

| Governance | ✅ Enterprise-grade | Standard |

| Causal Analysis | ❌ No | ✅ Core capability |

| Strategy Generation | ❌ No | ✅ Core capability |

| Margin Optimization | ❌ No | ✅ Core capability |

| AI Workers | ❌ No | ✅ Six autonomous agents |

| Price Range | $100K-300K+/year | $15K-50K/year |

| Ideal Customer | Enterprise, multi-brand | Mid-market DTC |

Summary: mParticle solves data quality and governance. Niti AI solves strategy generation and margin optimization. Different layers of the stack.

A2. Rudderstack vs. Niti AI

What Rudderstack Is:

Core Focus: Open-source customer data pipeline (Segment alternative)

Key Capabilities:

- Warehouse-first customer data platform

- 200+ source and destination integrations

- Event streaming and ETL

- Identity resolution

- Open-source core (self-hostable)

- Privacy and compliance

Ideal Customer:

- Developer-first teams

- Companies wanting open-source flexibility

- Brands with engineering resources

- Budget-conscious alternatives to Segment

Pricing: Free (open-source) to $50K+/year (cloud managed)

What Rudderstack Does Well:

1. Warehouse-Native Architecture

- Data lives in your warehouse first

- No proprietary data store

- Complete data ownership

- SQL-based transformations

2. Developer Experience

- Open-source transparency

- Self-hostable option

- Git-based workflow

- Extensive documentation

3. Cost Efficiency

- Free open-source tier

- Pay only for cloud hosting (if needed)

- Predictable pricing

- No vendor lock-in

4. Real-Time Activation

- Event streaming

- Reverse ETL capabilities

- Low-latency data flows

What Rudderstack Doesn't Do:

Strategic Intelligence Gap:

Rudderstack is pure infrastructure—more developer-focused than Segment but with the same strategic gap:

- ❌ No business intelligence: Moves data, doesn't analyze it

- ❌ No campaign creation: No strategy generation

- ❌ No offer optimization: Not margin-aware

- ❌ No AI agents: Pure data plumbing

After implementing Rudderstack, you need:

- SQL skills to query data

- Analysts to build insights

- Strategists to create campaigns

- Marketers to execute

Rudderstack is for engineering teams who want control over data infrastructure. It doesn't eliminate the need for strategic labor.

The Rudderstack + Niti AI Combination:

Rudderstack provides:

- Cost-effective data collection

- Warehouse-native architecture

- Developer control and flexibility

- Open-source transparency

Niti AI adds:

- Strategic analysis of warehouse data

- Campaign strategy generation

- Margin-aware optimization

- Non-technical interface (no SQL required)

Who this works for:

- Technical teams who built Rudderstack infrastructure

- Want to add strategic intelligence without hiring strategists

- Need business users to access insights without SQL

- Developer team focuses on infrastructure, Niti AI handles strategy

Key Comparison:

| Dimension | Rudderstack | Niti AI |

|---|---|---|

| Category | Data pipeline | Strategic intelligence |

| Core Value | Open-source flexibility | Campaign strategies |

| Primary Job | Collect, route, transform | Analyze, strategize, execute |

| Open Source | ✅ Yes | No |

| Self-Hostable | ✅ Yes | Cloud-only |

| Developer Focus | ✅ Very high | Low (business user focus) |

| SQL Required | ✅ Yes | ❌ No |

| Causal Analysis | ❌ No | ✅ Yes |

| Strategy Generation | ❌ No | ✅ Yes |

| AI Workers | ❌ No | ✅ Yes |

| Price Range | $0-50K/year | $15K-50K/year |

| Ideal Customer | Engineering teams | Business teams |

Summary: Rudderstack solves data collection cheaply for technical teams. Niti AI solves strategy generation for business teams. Complementary, not competitive.

A3. Census vs. Niti AI

What Census Is:

Core Focus: Reverse ETL and operational analytics (warehouse → business tools)

Key Capabilities:

- Sync data from warehouse to business tools

- Audience segmentation in warehouse

- Data activation workflows

- Visual segment builder

- 200+ destination connectors

- Real-time sync engine

Ideal Customer:

- Companies with data warehouses (Snowflake, BigQuery, Databricks)

- Data-forward organizations

- Teams wanting warehouse as source of truth

- Segment alternative for activation

Pricing: $20K-100K+/year

What Census Does Well:

1. Warehouse-Native Operations

- Your warehouse is the source of truth

- No data copying to external systems

- SQL-based segment building

- Data stays in your infrastructure

2. Business User Interface

- Visual segment builder (no-code)

- Template library for common use cases

- Sync monitoring and alerts

- Collaboration features

3. Operational Workflows

- Automated data syncs

- Scheduling and orchestration

- Dependency management

- Error handling

4. Data Activation

- Real-time syncs to business tools

- Field mapping flexibility

- Custom object support

What Census Is Starting to Add (Watch Closely):

⚠️ Census is evolving beyond pure infrastructure:

Recent additions:

- "Audience Hub" features

- Segment recommendations

- Basic analytics capabilities

- Some intelligence layer attempts

But still limited:

- No causal reasoning (correlational only)

- No strategy generation (you define segments)

- No margin optimization

- No autonomous campaign creation

Census is infrastructure with light intelligence features—not full strategic intelligence.

The Census + Niti AI Combination:

Census provides:

- Warehouse-native activation

- Data sync reliability

- Segment distribution to tools

- Visual interface for business users

Niti AI adds:

- Causal analysis determining which segments matter

- Strategy generation for what to do with segments

- Margin-aware offer optimization

- Complete AI worker team replacing strategic labor

Integration workflow:

- Niti AI analyzes warehouse data, generates strategies

- Niti AI defines audience segments based on strategy

- Census syncs those segments to execution tools

- Niti AI monitors results, regenerates improved strategies

- Census syncs updated segments

Key Comparison:

| Dimension | Census | Niti AI |

|---|---|---|

| Category | Reverse ETL + activation | Strategic intelligence |

| Core Value | Warehouse → tools sync | Campaign strategies |

| Primary Job | Activate data | Generate strategies |

| Warehouse-Native | ✅ Yes | ✅ Yes |

| Visual Segment Builder | ✅ Yes | ✅ Yes |

| Causal Analysis | ❌ Limited | ✅ Core capability |

| Strategy Generation | ❌ No | ✅ Yes |

| Margin Optimization | ❌ No | ✅ Yes |

| AI Workers | ❌ No | ✅ Six agents |

| Intelligence Layer | ⚠️ Basic (evolving) | ✅ Advanced |

| Price Range | $20K-100K+/year | $15K-50K/year |

Summary: Census is evolving from pure infrastructure toward light intelligence. Niti AI is full strategic intelligence. Census activates data well; Niti AI decides what data to activate and why.

A4. Fivetran vs. Niti AI

What Fivetran Is:

Core Focus: Automated data integration and ELT (Extract, Load, Transform)

Key Capabilities:

- 500+ pre-built data connectors

- Automated schema detection

- Data pipeline management

- Incremental updates

- Data transformation (dbt integration)

- Warehouse loading (Snowflake, BigQuery, etc.)

Ideal Customer:

- Data engineering teams

- Companies centralizing data in warehouses

- Organizations needing automated ETL

- Analytics infrastructure builders

Pricing: Usage-based (rows synced), $1K-50K+/month

What Fivetran Does Well:

1. Automated Data Integration

- Zero-maintenance connectors

- Automatic schema changes

- Incremental updates

- Error handling and retries

2. Broad Connector Coverage

- 500+ sources (databases, SaaS apps, events)

- Enterprise applications (Salesforce, NetSuite)

- Marketing platforms (Google Ads, Facebook)

- Custom connector SDK

3. Data Engineering Excellence

- Optimized for warehouse loading

- Column-level lineage

- dbt Cloud integration

- Modern data stack native

4. Reliability at Scale

- Enterprise SLAs

- Monitoring and alerting

- Support for high-volume syncs

What Fivetran Doesn't Do:

Marketing Intelligence Gap:

Fivetran is pure data engineering infrastructure—furthest from marketing strategy:

- ❌ No business intelligence: Gets data into warehouse, doesn't analyze it

- ❌ No marketing context: Not built for marketers at all

- ❌ No campaign creation: Zero marketing capabilities

- ❌ No strategic layer: Purely technical infrastructure

Fivetran is for data engineers, not marketers.

After implementing Fivetran:

- Data is in warehouse (great!)

- Now you need analysts to query it

- Strategists to interpret it

- Marketers to act on it

Fivetran + Niti AI is the most complementary pairing because they operate at completely different layers.

The Fivetran + Niti AI Combination:

Fivetran provides:

- Automated data collection from all sources

- Reliable warehouse loading

- Data engineering infrastructure

- Technical foundation

Niti AI adds:

- Business intelligence layer on warehouse data

- Marketing strategy generation

- Campaign optimization for profit

- Non-technical interface for business users

Perfect separation of concerns:

- Engineering team: Manages Fivetran (infrastructure)

- Marketing team: Uses Niti AI (strategy)

- No overlap, complete stack

Integration workflow:

- Fivetran loads data from all sources to warehouse

- Niti AI analyzes warehouse data for strategic insights

- Niti AI generates campaigns and segments

- Marketing team executes in tools (Klaviyo, Braze, etc.)

- Results flow back to warehouse via Fivetran

- Niti AI learns and improves

Key Comparison:

| Dimension | Fivetran | Niti AI |

|---|---|---|

| Category | Data integration (ELT) | Strategic intelligence |

| Core Value | Automated data loading | Campaign strategies |

| Primary Job | Get data into warehouse | Generate strategies from data |

| User Persona | Data engineers | Marketers, growth teams |

| Connector Count | ✅ 500+ | Standard marketing sources |

| Engineering Focus | ✅ Very high | Low (business focus) |

| Marketing Focus | ❌ None | ✅ Very high |

| Strategic Intelligence | ❌ Zero | ✅ Core product |

| Price Range | $1K-50K+/month | $15K-50K/year |

| Overlap | ❌ None | Different layers entirely |

Summary: Fivetran and Niti AI are perfectly complementary. Fivetran is data engineering infrastructure. Niti AI is marketing strategic intelligence. Zero overlap, complete stack together.

A5. Comparative Summary: All Infrastructure vs. Niti AI

The Infrastructure Landscape:

| Platform | Category | What They Do | What They Don't Do | Overlap with Niti AI |

|---|---|---|---|---|

| Segment | CDP Infrastructure | Collect, unify, route customer data | Generate strategies, optimize margins | Low - Different layer |

| mParticle | Enterprise CDP | Data quality, governance, multi-brand | Strategic intelligence, campaign creation | Low - Different layer |

| Rudderstack | Open-source CDP | Developer-friendly data pipeline | Business intelligence, strategy | None - Different audience |

| Census | Reverse ETL | Warehouse → tools activation | Full strategy generation | Medium - Evolving |

| Fivetran | Data Integration | Automated ELT to warehouse | Any marketing intelligence | None - Different layer |

| Hightouch | Smart Activation | Campaign optimization, AI decisioning | Strategy generation from scratch | High - See separate article |

Where Niti AI Fits:

The Missing Layer: Strategic Intelligence

All infrastructure platforms (Segment, mParticle, Rudderstack, Census, Fivetran) share a common gap:

They move data brilliantly. They don't decide what to do with it.

This is where Niti AI operates:

✅ Analyzes infrastructure-collected data (causal reasoning)

✅ Generates campaign strategies based on analysis

✅ Optimizes offers for margin preservation

✅ Creates execution-ready playbooks

✅ Learns from outcomes and improves

Niti AI is the intelligence layer that sits on top of infrastructure.

The Complete Modern Stack:

LAYER 1: Data Collection

- Fivetran (automated ELT)

- Rudderstack (open-source pipeline)

- Gets data from sources into warehouse

LAYER 2: Data Unification

- Segment (customer data infrastructure)

- mParticle (enterprise CDP)

- Unifies customer identities, ensures quality

LAYER 3: Data Activation

- Census (reverse ETL)

- Hightouch (smart activation)

- Syncs warehouse data to business tools

LAYER 4: Strategic Intelligence ← NEW LAYER

- Niti AI (autonomous AI workers)

- Generates strategies, optimizes margins, replaces labor

Decision Framework:

Choose infrastructure platforms (Segment, etc.) if:

- Your data collection is broken

- Customer profiles aren't unified

- Data quality is poor

- You need enterprise governance

- Integration is your bottleneck

Choose Niti AI if:

- Your infrastructure works (data flows fine)

- Your bottleneck is strategic capacity

- You can't afford $150K+ strategists

- You need campaign ideas, not better pipes

- You want margin-aware optimization

Choose BOTH if:

- You're building complete growth infrastructure

- Want perfect data foundation AND strategic intelligence

- Serious about eliminating strategic labor bottleneck

- Ready to scale sophisticated campaigns profitably

The Infrastructure Era vs. The Intelligence Era

2015-2024: Infrastructure Era

- Companies invested billions in data infrastructure

- Segment, mParticle, Fivetran, Census, Rudderstack thrived

- Problem solved: Data collection, unification, activation

2024+: Intelligence Era

- Infrastructure is solved (commoditized even)

- New bottleneck: Strategic decision-making

- Question shifts: "Now that we have perfect data... what do we do with it?"

Niti AI represents the intelligence era:

- Infrastructure companies move data

- Intelligence companies decide what to do with data

- One provides pipes, the other provides brain

This is the paradigm shift.

The infrastructure is built. The intelligence layer is next.

Final Recommendation

If you use Segment, mParticle, Rudderstack, Census, or Fivetran:

Your data infrastructure is likely solved. Congratulations—you're ahead of 80% of companies.

Your strategic intelligence likely isn't. After spending $50K-200K/year on infrastructure, you still need expensive humans to:

- Analyze the data

- Generate strategies

- Design campaigns

- Optimize margins

Niti AI is the intelligence layer your infrastructure was waiting for.

We don't replace Segment (or any infrastructure platform).

We replace the expensive strategists analyzing Segment's data.

[Schedule a demo] to see how Niti AI's six AI workers generate strategies from your infrastructure-unified data—producing in hours what human strategists take weeks to create, at 1/10th the cost.

The infrastructure is built.

Add the intelligence.